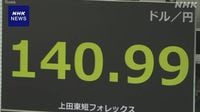

On April 21, 2025, the yen exchange rate temporarily surged into the 140 yen range against the dollar, marking a significant shift in the foreign exchange market. This is the first time in approximately seven months that the yen has reached this level, reflecting a notable appreciation of the Japanese currency. The movement comes amid speculation surrounding upcoming discussions between Japanese Finance Minister Shunichi Kato and U.S. Treasury Secretary Janet Yellen, scheduled for April 24.

The Tokyo foreign exchange market witnessed a strong trend of dollar selling and yen buying, leading to this rise in the yen's value. As of the latest reports, the dollar was trading at around 140 yen and 76 sen, indicating a significant depreciation of the dollar against the yen. This fluctuation is not only a reflection of market dynamics but also tied to broader economic narratives, particularly those involving U.S. monetary policy and international trade considerations.

The yen’s recent appreciation has been interpreted through the lens of U.S. President Donald Trump’s administration, which has previously characterized currency manipulation as a non-tariff barrier. Trump's remarks suggesting that the U.S. might demand corrections to perceived currency manipulations have raised concerns among investors about the potential impact on trade relations. According to reports, there is a growing belief that the U.S. will request a correction of the weak yen and strong dollar during Kato's visit.

"The yen's rise is significant for both economic and diplomatic reasons," said an analyst familiar with the situation. "It could lead to discussions on trade balances and currency policies that might affect market stability in the region." With the yen reaching this high level, questions arise about the implications for Japan's export-driven economy, which has traditionally benefited from a weaker yen that makes Japanese products cheaper overseas.

As the financial markets react to these developments, investors are closely monitoring the situation. The speculation surrounding Kato's meeting with Yellen has intensified discussions about potential shifts in U.S. monetary policy and its impact on global currencies. In recent weeks, the dollar's strength has been a focal point in conversations about inflation and interest rates, particularly as the Federal Reserve continues to navigate economic recovery post-pandemic.

Moreover, this situation is compounded by the ongoing geopolitical tensions that influence currency valuations. Analysts suggest that the U.S. may leverage its position to advocate for a stronger yen, which could in turn affect Japan's economic strategies. The dynamics of these discussions are critical, as any agreements or disagreements could have far-reaching effects on trade and investment between the two nations.

In the backdrop of these financial maneuvers, the Japanese government has been proactive in addressing concerns about the yen's volatility. The Bank of Japan has historically intervened in currency markets to stabilize the yen, and there is speculation that similar measures could be considered if the yen continues to appreciate significantly.

As the situation unfolds, the implications for the average consumer and business in Japan remain to be seen. A stronger yen could lead to lower import costs, benefiting consumers; however, it may also pose challenges for exporters who rely on competitive pricing in international markets.

Furthermore, the discussions between Kato and Yellen are anticipated to cover a range of topics, including inflation rates, economic growth projections, and trade agreements. The outcome of this meeting could set the tone for future economic policies and currency strategies between Japan and the United States.

In summary, the recent surge of the yen against the dollar highlights the intricate and often volatile nature of international finance. With Kato's upcoming meeting with Yellen, all eyes will be on how these two economic powers navigate their currency relations amidst a backdrop of global economic uncertainty. Investors and policymakers alike are bracing for potential changes that could reshape the economic landscape in both nations.