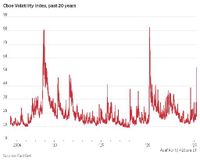

On April 4, 2025, the Cboe Volatility Index (VIX) surged dramatically, nearly doubling to over 45 as global stock markets faced a second tariff-related plunge. This spike in volatility marks a significant moment in financial markets, reminiscent of the panic seen during the early days of the COVID-19 pandemic in 2020.

The VIX, often referred to as Wall Street's 'fear gauge,' is designed to measure market expectations of near-term volatility. On that fateful Friday, the index closed at 45, a level not often reached, and typically indicates a short-term market bottom. Such a surge often signals a time for investors to consider buying, as panic can lead to overselling.

According to Mike Larson, a financial analyst, "We finally saw volatility take off on Friday. MoneyShow, an industry pioneer in investor education, indicates that the VIX doesn’t get as high as 45+ very often, and when it does, it tends to mark a short-term bottom." Larson's insights underline the critical nature of this volatility spike.

The surge in the VIX is particularly notable as it reached its highest level this year compared to Europe’s VStoxx Index and the HSCEI Volatility Index of major Chinese companies traded in Hong Kong. This indicates that the U.S. markets are leading the way in terms of volatility, with the VIX reflecting heightened expectations for U.S. equity movements.

As of April 7, 2025, the VIX had climbed even further, standing at about 53, and had briefly exceeded 60 earlier in the trading session. Such levels have only been seen twice in the last two decades: during the financial crisis of late 2008 and early 2009, and again in early 2020 when the coronavirus pandemic sent markets into a tailspin.

The current volatility is exacerbated by a significant divergence between the VIX and the 10-year Treasury yield (10YR). This divergence has reached a critical tipping point, causing significant market turmoil. The 10YR yield has sharply declined, breaking through the 4.16% level and hitting critical targets at 4% and 3.90%. The key support now lies at 3.90%, and any failure to hold this level could lead to further declines.

As of April 4, the VIX had pierced through its critical resistance trendline, confirming expectations and triggering an explosive 50% rise. This dramatic surge echoes the volatility spike witnessed last in August 2024, highlighting the ongoing instability in the markets.

In terms of equity indices, Nasdaq Futures have dropped to 16,540. If the 16,480 level is breached, the next key supports are at 16,096, 15,714, and the major target at 15,330. The S&P 500 Futures have fallen to 4,860, with potential declines toward 4,772, 4,682, and the major target at 4,592 if this support level is lost. Meanwhile, Dow Futures are trading at 36,928, with critical support at 36,667. A breakdown below this level could see the Dow heading to 36,409, 35,990, and the major target at 35,315.

The longer-term implications of this divergence and subsequent breakout are potentially severe. The VIX's surge above 45 signals heightened risk aversion and an increase in market volatility, which could linger for an extended period, especially if economic and inflationary pressures remain elevated. Historically, VIX levels above 45 often correlate with periods of significant market stress.

As highlighted in a March 28, 2025 analysis, the stock market was already under pressure before this latest surge. The ongoing tariff disputes and economic uncertainties have left investors anxious, leading to increased volatility across global markets.

Market analysts are closely watching for any announcements from political leaders, particularly former President Donald Trump, who may influence market sentiment with news of potential deals ahead of the April 9 deadline. Such announcements could mark a potential shift in the tides, providing some relief to the beleaguered markets.

In the face of this volatility, investors are urged to remain vigilant. The current market dynamics suggest that volatility could persist, with further downside risks in both equities and yields. A decisive break in key levels across the VIX and Treasury yields will likely set the tone for the next phase of the market, with a bearish continuation scenario still dominant.

As this situation unfolds, the financial community remains alert to the implications of these market movements. The current environment reflects a critical inflection point, where the divergence between the VIX and the 10YR yield has exploded, pushing the markets into turmoil. Investors should be prepared for continued uncertainty as they navigate this challenging landscape.