The USD/CAD exchange rate has seen significant fluctuations recently, driven largely by the mounting trade tensions between the United States and Canada. President Donald Trump’s controversial plan to impose tariffs on Canadian imports is causing waves across financial markets, complicatings the economic outlook for both nations. The exchange rate opened at 1.4428, with traders witnessing ranges from 1.4422 to 1.4453 over the past few days. Closing at 1.4466, the Canadian dollar, or loonie, is grappling with the challenges posed by looming tariffs.

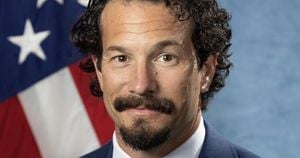

On Friday, the situation seemed precarious as Trump announced the imposition of tariffs on Canada, with expectations of rates possibly hitting 25%. Yet, U.S. Commerce Secretary Howard Lutnik hinted at potential for lower rates, stating, "Exactly what they are, we’re going to leave for the president and his team to negotiate." This uncertainty has traders on high alert as the impacts of these tariffs linger over market sentiments.

Recent economic indicators show Canada’s GDP rose by 2.6% for Q4 of 2024, surpassing forecasts of 1.9%. This uptick was not without its caveats, as underlying productivity, indicated via the GDP per capita, fell for the second consecutive year. Comparatively, over the last decade, the Canadian economy has only grown 1.9%, starkly contrasted with the U.S. boom of 14.7%. Such figures highlight the vulnerabilities Canada faces should trade tensions escalate.

The looming tariffs threaten to undercut demand significantly, especially as Canada relies heavily on U.S. markets for nearly 75% of its exports. Market analysts are expressing concern, as the imposition of tariffs may compel the Bank of Canada to implement prolonged interest rate cuts. This would only serve to weaken the loonie, complicate trade relations, and potentially trigger retaliatory measures from Canada.

Recent data from the U.S. on personal consumption expenditures (PCE) revealed slower consumer spending, adding to the uncertainties surrounding Federal Reserve monetary policy. The softening economic indicators have prompted speculation of potential rate cuts from the Fed, with the likelihood rising to 74% for the June meeting, according to the CME FedWatch tool. With weakening consumer sentiment, the market's focus is on the upcoming U.S. ISM Manufacturing Purchasing Managers’ Index (PMI) report.

Trump’s previous statements suggested there was no room for negotiation on tariffs. "The tariffs, you know, they're all set. They go to effect tomorrow," he announced during one of his press conferences, emphasizing his administration's firm stance. This has sparked concerns among investors, as the USD/CAD jumped to around 1.4520 at one point, reflecting the volatility of the currency pair under these circumstances.

Market analysts are keeping their eyes on the factors influencing the forex market closely, particularly how Trump's tariff announcements impact overall economic tensions. The USD/CAD pair started the new week lower, reflecting investor anxieties about the impending tariffs and the broader economic conditions. The consensus suggests it might snap its six-day winning streak following public doubts about consumer spending and broader economic growth.

Technical analysts say the USD/CAD appears to be caught at the 0.5 Fibonacci retracement level, with bullish sentiment stalling around this pivotal area. Should the pair breach this resistance, observations point toward potential growth toward the 1.4600 and beyond. On the flip side, any conclusive drop below the 30-day Simple Moving Average could indicate bearish tendencies, prompting the pair to revisit lower supports.

Throughout this week, all eyes are set on the U.S. manufacturing data, which could prompt responsive actions from federal monetary policy and influence traders’ expectations surrounding the Federal Reserve’s rate-setting decisions. With geopolitical dynamics coming to the forefront, particularly Trump’s proposed 25% tariffs not only against Canada and Mexico but China as well, traders are set to absorb any ripple effects these tariffs may have on the global economy.

While the Canadian dollar faces pressures from the looming tariffs, the broader forex market is nervously gauging the economic repercussions and sentiment shifts following the USD’s recent behavior. Should Trump’s tariffs remain aggressive and non-negotiable, traders expect the CAD will likely respond negatively, creating volatility across the financial markets.

For now, the outlook remains cautiously optimistic; traders are preparing for potential shocks from both the announcements about tariffs and upcoming economic data releases. With the USD/CAD exchange rate's current standing, the volatility may continue to challenge traders, as they analyze both the economic indicators and the political responses driving the currency movements.

Anticipation for the ISM Manufacturing PMI will likely influence immediate trading sentiments, indicating how manufacturing sectors are resisting or adapting to these mixed economic signals and what this means for future monetary policies.

Overall, the USD/CAD exchange rate is at the mercy of broader trade dynamics and economic indicators, with analysts foreseeing turbulent times regardless of the outcome of Trump's tariff plans. Stakeholders must remain vigilant as the financial forecasts intertwine with geopolitical narratives, preparing for what may emerge as one of the most complex trade disputes between the two North American allies.