On March 2, 2025, President Donald Trump revealed plans for the United States to establish strategic reserves for cryptocurrencies, including prominent players like Bitcoin (BTC), Ethereum (ETH), and lesser-known altcoins such as Solana (SOL), Ripple (XRP), and Cardano (ADA). This announcement triggered immediate fluctuations across the cryptocurrency market, sending Bitcoin to recent highs before the market responded with sharp declines.

After the announcement, Bitcoin briefly surged to $94,000, yet soon plummeted to around $86,000, reflecting over 8% losses within 24 hours. The sell-off wasn’t limited to Bitcoin; Ethereum, Solana, XRP, and Cardano all recorded drops of over 15% as investor enthusiasm quickly evaporated.

The turbulent market activity can be linked to broader concerns surrounding tariffs and inflation, particularly due to Trump's reaffirmation of his trade policies. This slump followed the announcement of impending tariffs on Canada and Mexico, which were set to kick off on March 4, alongside potential increases on Chinese tariffs. Market analysts noted these developments not only influenced stock markets, including the Dow, S&P 500, and NASDAQ, but also cast uncertainty over cryptocurrencies.

Trump's strategic focus on digital assets was made via his social media outlet, Truth Social, where he directed efforts toward creating cryptocurrency reserves infused with major altcoins, stating, "I would like to see Bitcoin and Ethereum also included as central to the reserves." This declaration ignited excitement initially, but the notion of including obscure cryptos has bred skepticism within the industry.

Industry insiders have been vocal about their uncertainties. Philip Lagerkranser, an industry analyst, remarked, "The initial enthusiasm has quickly faded as questions arise about the viability of the plan." This skepticism has reverberated through the market, influencing trading decisions and outlook on the future of these digital assets.

Despite the surges observed with various cryptocurrencies, their values crashed harder following the initial hype. XRP fell approximately 11%, Solana saw declines of about 18%, and Cardano experienced reductions of around 10%, as Bitcoin dipped below the $90,000 mark. Analysts expressed concerns about the real benefits of integrating lesser-known cryptocurrencies, especially against the backdrop of Trump's uncertain trade policies.

The overall sentiment among cryptocurrency investors seems to indicate caution. Arthur Hayes, co-founder of Bitwise, stated plainly, "Nothing new is happening here... tell me when the government gets congressional approval for this debt." Such comments encapsulate the frustration and skepticism surrounding the announcement, emphasizing the prevailing doubts within the cryptocurrency community.

While Trump’s plans may mark a progressive step for government involvement with digital currencies, many warn of the ramifications if these initiatives aren't adequately substantiated. With rising tariffs and fluctuative policies casting shadows over the market, these factors create a backdrop of uncertainty for potential investors and industry players alike.

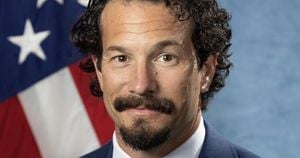

David Sachs, appointed as the crypto and AI point man for the Trump administration, mentioned upcoming discussions at the White House Cryptocurrency Summit on March 7, where more details about the policy's ramifications are expected to be unveiled. The summit could serve as a pivotal point for assuring both cautious investors and critics demanding clarity on governmental approaches to cryptocurrency reserves.

The cryptocurrency market's volatility post-announcement is significant, driven by speculation and differing opinions on the feasibility of including various altcoins as reserve assets. Hints of increased government oversight combined with Trump’s low approval ratings are raising alarms within the sector, as he seeks positive outcomes prior to election season.

Overall, Trump's vision for U.S. cryptocurrency reserves has spurred both bullish excitement and bearish skepticism, highlighting the complex balance between innovation and regulation. The coming weeks could reveal whether this approach will stabilize the cryptocurrency market or contribute to its continued uncertainty as key regulatory discussions progress.