On April 21, 2025, the New York stock market experienced a significant downturn, with the Dow Jones Industrial Average plummeting by 971.82 points to close at 38,170.41. This decline was influenced by a combination of factors, including growing concerns surrounding the potential dismissal of Federal Reserve (FRB) Chairman Jerome Powell, as U.S. President Donald Trump ramped up his criticism of the central bank.

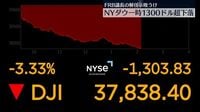

The Dow's drop was particularly alarming, as it at one point fell by over 1300 points during the trading day. Investors reacted to Trump's remarks, which indicated that the president was not only unhappy with Powell's leadership but was also suggesting that the FRB should implement immediate interest rate cuts to stave off an economic slowdown. Trump took to his social media platform, Truth Social, to voice his concerns, claiming that 'preventative rate cuts' were being requested by many people and asserting that inflation was nearly nonexistent due to falling energy and food prices.

Trump's social media post on that day stated, 'If [Powell] doesn’t cut rates now, we risk an economic slowdown.' He referred to Powell as 'Mr. Too Late' and labeled him a 'loser,' criticizing the chairman for allegedly having acted in favor of former President Biden during the 2024 election cycle.

Market analysts noted that Trump's escalating pressure on Powell was causing unease among investors, particularly regarding the independence of the central bank. Many were concerned that Trump's threats to dismiss Powell could undermine the FRB's credibility and its ability to manage monetary policy effectively. As a result, fears of financial market turmoil led to a broad sell-off in stocks.

The S&P 500 index also reflected this turmoil, temporarily falling nearly 3% amid concerns about Powell's position. Trump's remarks about potentially ousting Powell only added to the anxiety on Wall Street, as investors began to question the stability of the FRB under such political pressure.

In the wake of the stock market's decline, there was a notable shift in investment patterns. While stocks were sold off, there was a significant influx of capital into gold, traditionally viewed as a safe-haven asset during times of economic uncertainty. On the New York Mercantile Exchange, gold futures for June delivery rose by $96.90 to reach $3,425.30 per ounce, marking a new record high.

Despite the turmoil, some sectors saw contrasting movements. For instance, while tech stocks suffered, with the NASDAQ Composite Index falling by 415.55 points to 15,870.90, sporting goods giant Nike saw an increase in demand, indicating a mixed reaction among different market sectors.

Trump's aggressive stance against Powell and the FRB has drawn criticism from various quarters, including members of Congress who question whether the president has the authority to dismiss the chairman. Many lawmakers and economists are wary of the implications of shifting blame for economic challenges onto the FRB, particularly as the country grapples with the effects of high tariffs and their impact on inflation.

On April 17, Trump indicated that if he wanted to remove Powell, he could do so, stating, 'If I want to oust him, he'll be gone soon.' This kind of rhetoric has raised eyebrows and led to speculation about the future of monetary policy in the U.S.

As the situation continues to unfold, market participants are keeping a close eye on the interplay between the White House and the FRB. The uncertainty surrounding Powell's tenure and the potential for shifts in interest rate policy are likely to keep investors on edge in the coming weeks.

While Trump’s calls for immediate rate cuts resonate with some investors who fear a slowdown, others caution against making hasty decisions that could destabilize the economy further. Economists have warned that Trump's tariff policies could inadvertently lead to inflationary pressures, counteracting any benefits from rate cuts.

In summary, the events of April 21, 2025, serve as a stark reminder of the delicate balance between political influence and economic policy. As President Trump continues to challenge the FRB's leadership, the implications for the U.S. economy remain uncertain, leaving investors and analysts alike to ponder the future of monetary policy amidst a backdrop of political volatility.