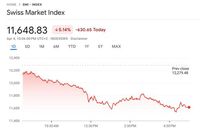

Zurich, Switzerland – The Swiss Market Index (SMI), the country's leading stock index, endured a significant downturn on Thursday, April 4, 2025, closing sharply lower amid a wave of selling that swept across European markets. The blue-chip index finished the trading day at 11,648.83, marking a substantial decline of 5.14%. This significant drop represents a loss of 630.65 points within the session.

Data from INDEXSWX, recorded at 10:06 PM UTC+2, illustrated a day dominated by sellers. The SMI opened significantly below its previous closing level of 12,279.48 and embarked on a steady downward trajectory throughout the morning. The selling pressure intensified around midday, pushing the index below the 11,800 mark. Afternoon trading saw increased volatility with brief attempts at recovery, but these failed to hold, and the index slid further to finish near its lowest point of the day.

This major sell-off in the SMI, which comprises the 20 largest and most liquid stocks on the SIX Swiss Exchange, highlights significant investor unease impacting major Swiss corporations and reflects the broader negative sentiment prevalent in financial markets.

The situation deteriorated further as the SMI faced additional pressures from ongoing global economic uncertainties. On Monday, April 7, 2025, the Swiss benchmark index is expected to fall by around two percent in pre-market trading, according to market analysts. Last week alone, the SMI had already lost more than nine percent, effectively wiping out the double-digit price gains seen at the beginning of the year.

The escalating trade war initiated by U.S. President Donald Trump has been a significant catalyst for these declines. Experts warn that the customs dispute could lead to rising inflation and potentially plunge the economy into a recession. "The risk of recession has increased significantly," commented a broker from IG, reflecting the sentiment of many in the financial sector.

Numerous strategists, including those at JPMorgan, are also increasing the probability of an economic downturn in their models. The broker indicated further losses for other major European indices, with the German DAX expected to fall by more than four percent and the British FTSE 100 by around 2.5 percent.

Meanwhile, losses are anticipated for U.S. shares as well, with projections indicating declines of between three and five percent. The turmoil is not limited to Europe; stock markets in Asia have also reacted sharply, with the Shanghai Composite Index plummeting by more than six percent, Hong Kong's Hang Seng Index dropping over ten percent, and Japan's Nikkei falling nearly seven percent.

Market analysts suggest that the extent of the recent sell-off has overwhelmed investors. The situation escalated after Trump announced major tariff increases, which sent shockwaves across global markets. In retaliation, Beijing imposed tariffs of 34% on U.S. goods, further intensifying the already tense trade relations.

As the markets continue to react to these developments, analysts caution that the volatility may persist. The SMI's significant drop reflects broader concerns about the stability of the global economy, and investors are urged to remain vigilant as the situation unfolds.

In summary, the Swiss Market Index's recent performance illustrates the interconnectedness of global markets and the impact of geopolitical events on local economies. As investors brace for potential further declines, the focus remains on how the ongoing trade tensions will shape market dynamics in the coming weeks.