On April 22, 2025, RTX (NYSE: RTX), a major player in the aerospace and defense sector, saw its stock plummet over 8% in early trading despite reporting impressive first-quarter earnings that exceeded Wall Street expectations. The decline raised eyebrows among investors who were quick to scrutinize the company’s cautious outlook for 2025.

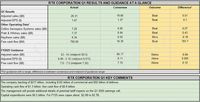

In its Q1 2025 earnings release, RTX announced adjusted earnings per share of $1.47, surpassing analysts’ consensus estimate of $1.35 and marking a 10% increase from the previous year’s $1.34. The company’s revenue also reached $20.3 billion, exceeding the forecasted $19.81 billion and reflecting a 5% increase from the $19.3 billion reported in Q1 2024. Notably, RTX highlighted an 8% organic revenue growth, significantly propelled by a robust performance in the commercial aerospace aftermarket, which experienced a remarkable 21% year-over-year surge.

However, the overall net income for RTX fell by 10% year-over-year to $1.54 billion, primarily due to the absence of one-time gains that had bolstered the previous year’s results. This decline in net income, coupled with the cautious guidance for the future, seemed to unsettle investors.

Breaking down the segments, Collins Aerospace reported an 8% year-over-year revenue increase to $7.22 billion, with operating profit soaring 28% to $1.09 billion. Pratt & Whitney also performed well, reporting a 14% rise in revenue to $7.37 billion and a 41% increase in operating profit to $580 million, driven by heightened demand for large commercial engines. In contrast, Raytheon faced challenges, experiencing a 5% revenue decline to $6.34 billion and a 32% drop in operating profit, largely due to the lack of a prior-year gain from a business divestiture.

Despite the strong performance in Q1, RTX’s stock was significantly affected by the company’s guidance for 2025. The firm maintained its forecast for full-year adjusted EPS of $6.00 to $6.15, which fell slightly short of Wall Street’s midpoint estimate of $6.11. Additionally, RTX projected revenue between $83 billion and $84 billion, which was under the Street’s expectation of $84.17 billion.

CEO Chris Calio addressed the cautious outlook during the earnings call, stating, “The current environment is clearly very dynamic,” while expressing confidence in RTX’s long-term positioning. He added, “We remain well-positioned operationally to navigate challenges and capitalize on demand.” However, he also noted that the guidance did not account for potential tariff impacts, which added another layer of uncertainty.

In the wake of these developments, analysts remained cautiously optimistic about RTX. The stock still holds a Strong Buy consensus among analysts, with 12 Buys and four Holds issued in the last 90 days. The average 12-month price target stands at $144.75, suggesting an upside potential of over 14% from current levels. Nevertheless, the early Tuesday selloff erased part of its 9.5% year-to-date gain, and RTX now trades with caution among investors as they digest the long-term implications of a slightly weaker-than-expected full-year forecast.

Concerns about tariffs also weighed heavily on RTX’s stock performance. The company indicated that it is bracing for an $850 million hit to operating profits due to tariffs stemming from President Donald Trump’s trade war. This includes $250 million from Canada and Mexico, as well as $250 million from duties on trade with China. On April 22, 2025, RTX shares fell about 4.5% in pre-market trading, reflecting these tariff-related concerns.

In summary, while RTX reported solid Q1 earnings, the combination of a cautious guidance outlook and potential tariff impacts has left investors wary. The stock’s decline on April 22 serves as a reminder of the challenges facing the aerospace and defense giant as it navigates a complex and dynamic market environment.

As analysts continue to evaluate RTX’s performance, the consensus remains that the company has strong fundamentals, evidenced by a backlog amounting to $217 billion and a commitment to leveraging its competitive advantages. The outlook may be clouded by short-term uncertainties, but RTX’s strategic execution and robust demand in key segments provide a foundation for future growth.

In the coming months, RTX will need to demonstrate its ability to adapt to evolving market conditions and address investor concerns regarding tariffs and guidance. The aerospace and defense industry remains competitive, and how RTX maneuvers through these challenges will be closely watched by both analysts and investors alike.