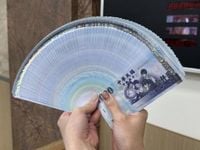

The New Taiwan dollar fluctuated significantly on March 21, 2025, against the backdrop of a declining stock market and ongoing concerns about international trade tariffs. The currency closed at 32.988, an appreciation of 1.9 points, but not without its challenges as foreign capital continued to exit Taiwan's markets.

On this day, the Taiwan stock market fell by 168.16 points, ending at 22,209.1, with considerable selling from foreign investors totaling 176.84 billion NTD. The outflow of hot money has been a continuing concern, putting pressure on the New Taiwan dollar which at one point dipped as low as 33.054 during intraday trading.

Yang Jinlong, President of the Central Bank, spoke about the situation, stating, "Recent large amounts of foreign capital selling stocks and remitting funds led to the New Taiwan dollar exchange rate breaking the 33 mark, but it should only be a short-term phenomenon." His comments reflect the transient nature anticipated for these currency movements despite today's minor gain.

Throughout the trading day, the New Taiwan dollar began at a weaker opening of 33.02, which represented a depreciation of 1.3 points from the previous close. However, afternoon trading saw increased selling from exporters who began to take advantage of the favorable rates, prompting a rebound and closing price that marked its return to the 32 range.

This fluctuation came amid a backdrop of increased confidence in the U.S. dollar, spurred on by the Federal Reserve's announcement that there was no immediate intention to cut interest rates. This led to a rebound of the U.S. dollar index by 0.34%, while Asian currencies performed variably against it. The Japanese yen fell 0.48%, the renminbi depreciated by 0.13%, and the Singapore dollar saw a slight decline. In contrast, the New Taiwan dollar managed an increase of 0.06%, as did the Korean won which appreciated by 0.14%.

Factors contributing to the decline in stock prices and pressure on the New Taiwan dollar include rhetoric surrounding President Donald Trump's tariff policies, particularly fears of the 'dirty 15' nations list, which includes Taiwan. As these policies and their potential implications loom, investors appear wary, leading to diminished investor sentiment and further selling.

The liquidity in foreign exchange markets grew significantly with a total transaction value reaching 1.9435 billion US dollars for the day, despite the ongoing concerns about hot money leaving Taiwan. Analysts have noted that the technical patterns of Taiwan stocks indicate signs of potential strength; however, these are countered by uncertainties tied to international trade and tariff implications.

As Taiwan approaches the announcement of equal tariffs scheduled for April 2, these economic cues will likely continue presenting challenges for the currency and the stock market alike. The discussions surrounding these tariffs are expected to involve key technology and manufacturing sectors, adding an extra layer of complexity and risk for investors.

In the context of these developments, market watchers and currency supervisors remain cautious about the trajectory of the New Taiwan dollar. Although current trends show a brief respite, sustained pressure from foreign capital outflows and uncertain international trade conditions may hinder the currency's recovery.

In summary, while the New Taiwan dollar closed with slight gains today, the overarching trend points to an enduring battle against foreign capital outflows and geopolitical uncertainties, particularly regarding U.S. economic policies that impact Taiwan's export economy.