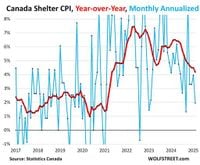

As inflation continues to creep back into discussions across North America, recent reports reveal troubling trends for both Canada and the United States. In February 2025, Canada experienced a spike in its Consumer Price Index (CPI), rising by 0.68% from January. This marked the worst month-to-month increase since inflation rates peaked in June 2022. Month-to-month increases were reported in six out of eight major categories, with food prices skyrocketing by 2.04% (an annualized rate of 27%). Meanwhile, U.S. inflation data for January echoed similar concerns, showing a CPI increase to an annual reading of 3%, with core inflation exceeding that at 3.3%. These recent developments are reigniting worries among economists and consumers alike regarding the future state of household finances.

According to the Economics and Strategy shop at the National Bank of Canada, "The data published this morning by Statistics Canada is enough to shake observers’ convictions about the inflation situation in the country." Their commentary pointed to the inevitable acceleration of inflation due to factors such as the phased end of the Goods and Services Tax (GST) holiday mid-month, implying current price hikes could be indicative of broader economic shifts.

In the United States, the Federal Reserve convened on March 19, 2025, opting to hold interest rates steady between 4.25% and 4.50%. The decision comes amid growing pessimism about the economic landscape, particularly with potential tariff plans affecting the American economy. Dr. Brandon Parsons, an economist at Pepperdine Graziadio Business School, explained, "It is unlikely the Federal Reserve will reduce interest rates if inflation remains above 3%." This sentiment alarms many middle-class Americans, who are already feeling the pinch of rising costs in essentials like food, healthcare, and shelter.

Robert Frick, an economist at Navy Federal Credit Union, noted, “Prices are rising most for necessities, so they’re tough to avoid,” highlighting the struggles faced by many families as purchasing power diminishes. The tightening of the budget is becoming a reality, as families adopt strategies to cope with the increasing cost of living. Some are shopping at discount retailers more often or reassessing personal expenses like subscriptions.

In the housing market, affordability continues to be a pressing issue, especially for first-time homebuyers facing mortgage rates that have remained consistently high, often exceeding 6%. With many opting to stay put in their low-rate homes, housing inventory remains low, further complicating the market for newcomers. Tariffs imposed on trading partners, including Canada and Mexico, have only added to the challenges, with predictions from analysts indicating car prices could surge by an additional $2,700 due to such measures.

The Bank of England is also grappling with its own set of challenges as it prepares for its next interest rate decision on March 20, 2025. Analysts predict they will hold rates steady, as recent data shows the UK's CPI unexpectedly jumped to 3%, significantly above their 2% target. City forecasters revised growth expectations down to just 1% this year—indicating concerns over potential economic stagnation. The OECD has even lowered its growth forecast for the UK to 1.4% from 1.7%.

"With such an unpredictable leader at the helm of the world's largest economy, the scope for policy makers to make effective decisions diminishes with every new announcement," remarked Isaac Stell, an investment manager at Wealth Club. Such remarks underline the broader uncertainty seeping into both the U.S. and UK and its potential ramifications on the global stage.

The implications of rising inflation rates thus extend well beyond just immediate price increases; they raise fundamental questions regarding the long-term stability of household budgets and economic growth prospects in both nations. As families reassess their financial positions, many are seeking ways to earn more or invest in inflation-resistant assets like real estate and gold to mitigate future risks. Paradoxically, even as inflation lingers at higher than expected levels, consumers may be forced to come to terms with a new normal of elevated prices.

Ultimately, as inflation continues to be a significant narrative across Canada, the U.S., and the UK, central banks will have their hands full navigating the tumultuous waters of price stability and economic growth. Experts agree that careful consideration of broader economic indicators will be crucial in determining if interest rates need to be adjusted in response to the ongoing inflationary pressures. The prospect of tighter budgets and unstable market conditions highlights the necessity for ongoing vigilance from both consumers and policymakers.