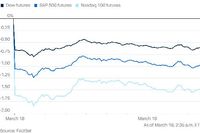

The U.S. stock market experienced a significant rally on March 19, 2025, after the Federal Reserve announced it would hold interest rates steady at a range of 4.25% to 4.5%. This decision was coupled with a downgrading of its economic growth projections while simultaneously increasing its inflation expectations for the year. The news elicited widespread reactions, with the tech-heavy Nasdaq Composite pushing upwards by more than 1.4% and the Dow Jones Industrial Average climbing 375 points, or 0.9%. The S&P 500 also benefitted from the Fed's announcement, finishing up 1.1% on the day.

Federal Reserve Chair Jerome Powell characterized the announcement as one of relative steadiness amidst ongoing uncertainty regarding inflation driven primarily by potential tariffs from the Trump administration. In his press conference following the meeting, Powell stated, “The economy seems to be healthy. We understand that that sentiment is quite negative at this time. And that probably has to do with the turmoil at the beginning of an administration that's making big changes in areas of policy.”

Powell's comments were primarily focused on addressing the inflationary impacts from the expected tariffs, which he anticipated would likely be “transitory.” He supported this viewpoint with the assertion that the risks of recession remain low, although he acknowledged that expectations of a recession had increased—moving from perceived extremes not long ago to a moderate 20% probability according to forecasts by Goldman Sachs.

The Fed's revised economic outlook indicated that inflation was expected to hit 2.7% by the end of the year, a hike from December's 2.5% projection. The seemingly contradictory nature of increasing inflation expectations alongside lowered growth projections reflects a complex economic reality where tariff-induced inflation impacts are becoming more pronounced. Powell stated, “A good part of [higher inflation expectations] is coming from tariffs,” indicating the Fed's recognition of the significant role that current trade policies are playing in the fragile balance of the economy.

While some Fed officials are projecting two interest rate cuts this year as part of their forecast, not all agree. Nine members are looking for two cuts, while eight anticipate fewer than that. The divergence in opinions among Fed policymakers illustrates the broader uncertainty surrounding U.S. fiscal policy and its trajectory.

On the stock market front, shares of Nvidia surged by 1.8% following the Fed's announcement. After recently facing significant losses, the tech firm is trying to regain its footing amidst a volatile market, largely helped by recent industry announcements and investor interest in their AI developments. Similarly, Tesla stock rebounded by more than 4.5% thanks to an upgrade from Cantor Fitzgerald, reflecting a perceived turnaround in investor sentiment.

Despite these positive signals, the broader concern among investors remains centered on ongoing fluctuations in economic forecasts prompted by tariff negotiations and potential policy changes from the federal government. Powell's statement, “If you go back two months, people were saying that the likelihood of a recession was extremely low,” reveals the shifting sentiment surrounding the economic outlook.

The intricacies of U.S. economic policy are further complicated by evolving trade relations internationally. The Federal Reserve's insistence that the impacts of tariffs and other economic factors are known yet complicated suggests that businesses will need to be alert to new data points and trends as they develop. Powell underscored the necessity for vigilance, proclaiming, “We will be watching very carefully for signs of weakness in the real data. Of course we will.”

The decision to maintain interest rates was reflective of an intention not to disrupt the ongoing market rally, but it still leaves open the notion that the Fed is prepared to adapt as needed. Indeed, the overall economic projections point toward a slowing growth rate of 1.7% for the year, down from optimistic forecasts previously published, thereby rekindling investor attention on future Fed meetings and potential market reactions.

In contrast to this, rental markets showed slight relief as average rents fell to $1,691 last month, representing a dip from January figures. However, there are concerns that supply shortages could reverse this trend if new rental units fail to meet demand.

Overall, markets are demonstrating a cautious optimism with the Federal Reserve's current trajectory on monetary policy, but as Chair Powell concluded, the road ahead remains fraught with uncertainty stemming from trade risks and a potentially fluctuating economic landscape. The upcoming months will certainly reveal whether the Fed’s expectations align with real-world economic conditions.