On February 5, 2025, significant fluctuations were observed in the exchange rates of the Australian Dollar (AUD) against the US Dollar (USD) and the USD against the Swiss Franc (CHF), driven by recent economic data released from the United States.

The AUD/USD currency pair witnessed notable movement as the day closed, reflecting investor reactions to various economic indicators. The US dollar index stabilized at 107.500 following the release of the private-sector employment report by ADP, which indicated the addition of 183,000 jobs in January 2025. This figure exceeded expectations of 176,000 jobs and illustrated the robustness of the labor market, sparking hopes of economic stability moving forward.

While the job addition figures suggested strength, other economic indicators revealed slight declines. The Services Purchasing Managers' Index (PMI) for January dropped to 52.9, down from 56.8 the previous month, pointing to a softer economic activity within the services sector. Similarly, the non-manufacturing PMI issued by the Institute for Supply Management (ISM) registered at 52.8, compared to 54.0 previously, signaling potential slowing growth which could temper investor sentiment.

On the Australian side, economic data was mixed. The Services PMI saw slight improvement, moving to 51.2 from 50.8 the prior month. Despite this positive trend, other indicators such as the AIG performance index for the construction sector fell to -20.0, and the agricultural performance index also dipped to -22.7 from -17.9. This overall snapshot of Australia’s economy keeps investor focus sharp, awaiting more data to assess whether economic activity will brighten or darken.

The volatility of the AUD/USD pair remained closely tied to the fluctuative nature of these economic reports. Investor expectations on the Federal Reserve's potential interest rate hikes were shaped largely by the performance of the US labor market bolstered by weak growth signals from other sectors. Consequently, these mixed signals have made traders cautious as they navigate through the intricacies of currency positions.

The USD/CHF pair displayed significant declines at the end of the trading session as well, attributed to the same set of US economic reports. The absence of fresh economic news from Switzerland allowed the Swiss Franc to exhibit relative strength against the dollar. Observers noted the prevailing downward pressure on the dollar amid varied US economic outlooks.

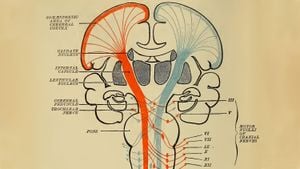

Digging more deeply, technical analysis of the USD/CHF revealed notable patterns, with the currency moving within a defined bearish structure. The dollar showed repeated tests below its established downtrend, implying the likelihood of continued downward momentum. The Relative Strength Index (RSI) was resting at 35, indicating growing bearish sentiment, and the Average Directional Index (ADX) reflected moderate strength at 37, impacting traders' strategies.

Charts illustrating these movements and trends provide traders with insight, emphasizing the significance of demand and supply zones, Fibonacci levels, as well as price trends and various indicators like RSI and moving averages. With current conditions, analysts suggest the likelihood of continued trajectories ranging between 60% to 70%, but they stress the importance of cautious risk management strategies during trading.

Market analysis serves as merely one component of the investor's decision-making process. Operators must exercise diligence and prudence, remaining aware of the risks associated with trading. These fluctuations highlight the dynamic interplay between economic data and currency performance, reinforcing the notion of strategic engagement for market participants.

With market forces continuously at play, keeping track of economic indicators from both the US and Australia—as well as remaining agile with trades based on shifts within these economic landscapes—will be imperative for investors as they respond to forthcoming data releases and trends.