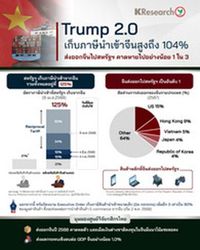

The recent imposition of Reciprocal Tariffs by the United States has sent shockwaves through the ASEAN region, particularly affecting countries like Vietnam and Cambodia. According to the Center for International Trade Studies Thailand, the tariffs are set at alarmingly high rates, with the CLMV countries facing tariffs as steep as 49%. Thailand and Indonesia are not far behind, with tariffs of 36% and 32% respectively, while Singapore enjoys the lowest rate in the region at 10%.

The Reciprocal Tariffs, which impact various goods, including semiconductors and vehicles, are expected to have a profound negative effect on the economies of ASEAN nations, particularly due to their reliance on exports to the U.S. Vietnam and Cambodia are at the highest risk of suffering economic downturns. If trade negotiations with the U.S. do not yield favorable results, Vietnam may struggle to attract foreign investment, leading to a projected 4.5% contraction in exports by 2025, down from a previous estimate of 12%. This decline is attributed to reduced demand for Vietnamese goods, particularly in electronics, furniture, textiles, and footwear.

Weeranam, a Vietnamese trade representative, highlighted the potential fallout from the tariffs, stating, "If trade with the U.S. is not successful, we may not attract as much foreign investment as before, and exports could shrink significantly." The expected direct impact on exports to the U.S. is a staggering 8.1% decrease in 2025, with industries reliant on the U.S. market facing the brunt of these challenges.

Meanwhile, Indonesia appears to be somewhat insulated from the worst effects of the tariffs, although it still faces challenges. The Indonesian government is preparing to negotiate with the U.S. to mitigate the impact on its processing industries. While the overall impact on Indonesia’s exports is forecasted to be a 3.3% decline, the country’s reliance on the U.S. market—accounting for 10% of its exports—means that the tariffs will still be felt significantly.

In contrast, Cambodia's economy is particularly vulnerable due to its heavy dependence on Chinese investment and exports. The imposition of a 49% tariff is expected to stifle foreign direct investment (FDI) and lead to a projected 5.3% contraction in exports by 2025. The Cambodian Ministry of Commerce has expressed concerns over the tariffs, arguing that the country already has an average import tax rate of 29.4%, which makes it difficult to compete.

As the situation unfolds, trade representatives from Cambodia have been vocal about their opposition to the tariffs, stating, "We do not agree with the 49% Reciprocal Tariff, and we are seeking avenues to negotiate with the U.S. government." The U.S. Trade Representative (USTR) has raised concerns regarding issues such as corruption and intellectual property rights, which Cambodia must address to improve its trade standing.

Laos is expected to experience indirect effects from the economic slowdown in China, which is a primary trading partner. The projections for Laos indicate a potential contraction in exports, particularly in textiles and footwear. The government has yet to issue a formal statement on the tariffs, but the USTR has highlighted concerns regarding high excise taxes on vehicles and transparency in customs processes.

Thailand's economy is also under threat from the new tariffs, with Jurin Laksanawisit, a member of the Democrat Party, stating that the U.S. market is crucial for Thai exports, accounting for 18.29% of total exports. The 36% tariff on Thai goods is expected to make Thai products more expensive and less competitive, particularly against countries with lower tariffs. Jurin warned that the impact on specific agricultural exports, such as rice and rubber, could be devastating for farmers, as the tariff hike is akin to a "double-edged sword" for Thai agriculture.

"The rice market is particularly concerning, as we export around 850,000 tons of rice to the U.S. annually. If we face a 36% tariff while competitors like Vietnam face a 46% tariff, we risk losing our market share," he explained. The Thai government is urged to expedite trade negotiations to alleviate the burden on exporters and farmers.

Phajon Aritamnuath, the Chairman of the Thai Chamber of Commerce, echoed similar sentiments, emphasizing the need for clarity regarding the tariffs and their implications for exporters. "The uncertainty surrounding the tariff rates is causing hesitation among importers and exporters alike, which could lead to a decline in orders and ultimately affect consumer prices in the U.S.," he warned.

During a recent roundtable discussion titled "Trump's Global Quake: Thailand Survival Strategy," industry leaders discussed the challenges posed by the new tariffs. Somphop Aritamnuath, Secretary-General of the Thai Animal Feed Manufacturers Association, noted that the food industry in Thailand has seen slow growth due to limitations in raw materials. He stressed that the 36% tariff on processed food exports to the U.S. could significantly harm Thai exporters who are already competing against countries with lower tariffs.

As the ASEAN countries grapple with the ramifications of the U.S. tariffs, the need for effective negotiation and strategic planning becomes increasingly vital. With the potential for further trade barriers looming, regional leaders must work collaboratively to ensure that they can navigate these challenges and protect their economies from the fallout of escalating trade tensions.

The situation remains fluid, and the outcome of ongoing trade negotiations will be critical in determining the future economic landscape for ASEAN nations. As the world watches, the stakes have never been higher for these countries as they seek to safeguard their economic interests in an increasingly unpredictable global market.