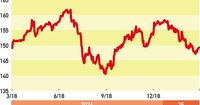

On April 7, 2025, the foreign exchange market saw the Japanese yen surge against the U.S. dollar, climbing over 1% to settle at approximately 145.40 yen per dollar. This notable rise comes amid escalating concerns over a potential trade war, which has prompted a wave of risk aversion among investors.

Treasury Secretary Janet Yellen has maintained a firm stance on tariffs, asserting their necessity while dismissing fears of an economic recession stemming from these measures. Yellen emphasized the need for careful assessment of proposals from other countries, stating, "We need to see what each country will propose and whether it is credible." Her comments reflect a broader strategy from the U.S. government, which seems unlikely to lower tariffs in the near future.

The yen's surge is also influenced by fears of retaliatory measures from China, which announced a 34% tariff on all imports from the United States as a counteraction to U.S. tariffs. This development adds to the anxiety surrounding global trade dynamics, with many market participants fearing that prolonged negotiations could lead to further economic slowdown.

As the Tokyo foreign exchange market opened on Monday, the dollar-yen rate was already feeling the pressure. The previous week had seen the yen reach a high of 144.56 yen per dollar, a level not seen since October 2024. Analysts at Nomura Securities noted that the market's risk sentiment is deteriorating, and warned that the yen could face upward pressure as fears about the trade conflict escalate.

On April 5, 2025, the Trump administration implemented a basic tariff rate of 10% on mutual tariffs, with additional tariffs set to take effect on April 9 for countries with significant trade surpluses with the U.S. This has heightened concerns about retaliatory tariffs and the potential for a full-blown trade war, which could significantly impact both the U.S. and global economies.

In light of these developments, the upcoming week is poised to be critical for the dollar-yen relationship, with several important economic indicators scheduled for release. On April 8, Japan will publish its February international balance of payments and trade balance, which could provide insights into the country's economic health amid these turbulent times.

On April 9, the U.S. will release the minutes from the Federal Open Market Committee (FOMC) meeting held in March. This meeting had already led to market reactions, as the Fed decided to maintain the current policy interest rate, raising concerns about potential economic slowdown. Analysts are particularly interested in the discussions surrounding this decision, as they may provide clues about future monetary policy directions.

The following day, April 10, will see the release of the March Consumer Price Index (CPI), a key measure of inflation that reflects the price changes of a basket of consumer goods and services. Market participants will be watching closely for the core index, which excludes volatile items like fresh food, to gauge inflationary pressures in the economy.

Additionally, the U.S. will report initial jobless claims and continuing claims on the same day, alongside the March monthly fiscal balance. These figures are crucial for understanding the labor market's health and the government's fiscal position.

On April 11, the Producer Price Index (PPI) for March will be released, along with the preliminary University of Michigan consumer sentiment index for April. These indicators will further inform the market about inflation trends and consumer confidence, which are vital for economic stability.

The recent announcement of tariffs by the Trump administration, including a notable 24% tariff imposed on Japan, has already led to a significant decline in the dollar-yen rate. As trade policies continue to evolve, the potential impact on both countries' economies is a pressing concern. Market analysts caution that if U.S. economic indicators underperform, it could lead to increased pressure on the dollar, prompting further declines against the yen.

With these developments unfolding, investors are urged to remain vigilant and monitor the situation closely. The interplay between U.S. tariffs, global trade relations, and economic indicators will be crucial in shaping the outlook for the dollar-yen exchange rate in the coming weeks.

The financial markets are poised for volatility as traders adjust their positions in response to these geopolitical and economic shifts. As the situation evolves, the implications for global trade and economic growth will be closely scrutinized.