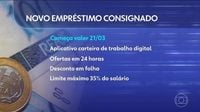

Today marks the launch of a significant new initiative by the Brazilian government, known as the 'Worker's Credit' program, designed to enhance access to payroll loans for over 47 million formal workers across the nation. Effective March 21, 2025, this program allows employees with formal contracts, including domestic and rural workers, to utilize part of their Fundo de Garantia do Tempo de Serviço (FGTS) as collateral, leading to effectively lower interest rates on loans.

According to the Minister of Finance, Fernando Haddad, under the old system, workers were often burdened with personal loan interest rates exceeding 5% per month. With the new payroll loan option, these individuals can exchange high-interest personal loans for much more favorable conditions, potentially reducing interest rates to below half of current levels.

"Today, there are roughly R$86 billion in personal loans at exorbitant rates. Workers will now have the opportunity to migrate to a payroll loan at more manageable interest rates, thus minimizing their risk of over-indebtedness," stated Haddad. The program aims to counteract the trend of increasing indebtedness, which many believe stems from high interest rates rather than excessive borrowing.

Eligible workers can access this program through the Digital Work Card application (CTPS Digital), where they will be able to request loans from over 80 financial institutions that have been authorized to participate. Once an application is submitted, the participating banks have up to 24 hours to respond with loan offers.

The Worker’s Credit permits individuals to utilize up to 10% of their FGTS balance as collateral, alongside 100% of the severance fine (the 40% payment upon dismissal without just cause). However, some aspects of using FGTS as collateral remain pending formal regulation by the FGTS Curatorial Council, which is expected to convene on June 15, 2025.

Francisco Macena, Secretary-Executive of the Ministry of Labor, explained, "The guarantee regarding the 10% and the 100% severance fine provision is included in the provisional measure. What still needs to be regulated is the manner of payment. There may be issues with banks, but these are anticipated to be minor."

Once implemented, the payroll loans will automatically deduct installments directly from the employee's salary, making the repayment process seamless. This setup not only aids workers in managing their financial obligations but also significantly reduces the risk of default for banks.

Despite the promising outlook, banking representatives from the Brazilian Federation of Banks (Febraban) have noted that initial demand may be modest while the operational processes are being adapted. The organization expressed confidence that increased understanding of the program will lead to a broader acceptance among the workforce.

The current situation offers a unique opportunity for formal workers—currently estimated at around 47 million in Brazil—to access credit in a more affordable manner. As noted by the government, the Worker’s Credit program encompasses diverse segments, from agricultural laborers to domestic workers and microentrepreneurs.

Workers will also be able to migrate existing payroll loans to this new model starting April 25, 2025. Portability between banks will be available starting June 6, 2025, giving employees additional flexibility to choose lenders that may offer better rates or terms.

Haddad emphasized, "The goal is to make loans more accessible and reduce the pressure associated with high-interest credit options." The optimism surrounding this program reflects a broader desire to bolster the financial security of the working class and stimulate economic growth.

For those concerned about potential changes in employment, the provision allows for seamless transitions; if a worker changes jobs, the new employer is responsible for continuing to deduct loan payments directly from the payroll.

The Worker’s Credit program represents not just a financial tool but a pivotal shift in access to credit for millions who previously faced barriers due to high interest rates. As the new system launches, its success will heavily depend on worker awareness, bank engagement, and effective implementation.

As the rollout unfolds, it is anticipated that the landscape of payroll loans in Brazil will evolve, potentially fostering a more inclusive financial system and alleviating the burden of costly borrowing for the nation’s workers.