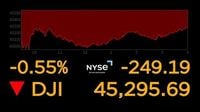

Wall Street faced a sharp downturn on Tuesday, September 2, 2025, as mounting pressure from the bond market dragged U.S. stocks further from their recent record highs. The S&P 500 experienced its worst day in a month, falling 0.7%, after briefly dipping as much as 1.5% earlier in the session. The Dow Jones Industrial Average dropped 249 points, or 0.5%, while the Nasdaq composite lost 0.8%. Despite these declines, all three major indexes remain relatively close to their all-time highs, a testament to the market’s resilience amid persistent uncertainty.

According to the Associated Press, the primary culprit behind the market’s slide was the rising yield on the 10-year Treasury note, which climbed to 4.27% from 4.23% late Friday. When bond yields rise, they make the guaranteed returns from government debt more attractive compared to the riskier world of stocks. As a result, investors tend to demand lower prices for shares, putting downward pressure on the market as a whole.

Big Tech stocks, which have long been the darlings of Wall Street, led the retreat. Nvidia, the chipmaker powering much of the world’s artificial intelligence revolution, fell 2% and was identified by the Associated Press as the single strongest force pulling the S&P 500 downward. Amazon slid 1.6%, while Apple lost 1%. These companies have soared in recent years, fueled by expectations that they will continue to dominate the global economy. However, critics have argued that their stock prices have become too expensive, making them especially vulnerable when market sentiment shifts.

The pressure on U.S. stocks was compounded by global trends. Longer-term bond yields have been rising around the world, driven in part by growing concerns about how governments will manage their swelling debts. In the U.S., these worries have been exacerbated by President Donald Trump’s recent criticism of the Federal Reserve for not cutting interest rates sooner. According to the Associated Press, some investors fear that a less independent Fed may hesitate to make the tough, unpopular decisions required to keep inflation under control—such as maintaining higher short-term rates than Wall Street would prefer.

Tuesday’s selloff also marked the first trading session since a federal appeals court ruled late Friday that President Trump overstepped his legal authority when he announced sweeping tariffs on nearly every country. The court’s decision left the tariffs in place for now, but the ruling added another layer of uncertainty to an already jittery market. Trump’s tariffs have created confusion across the global economy and, according to Wells Fargo Investment Institute’s Scott Wren (as reported by the Associated Press), may have hurt the U.S. job market. With less income from tariffs, the U.S. government could be forced to borrow even more to cover its obligations, further fueling concerns about debt and interest rates.

Amid this turmoil, investors sought refuge in traditional safe havens. The price of gold hit another record high, reflecting the metal’s longstanding reputation as a store of value in uncertain times. Meanwhile, Treasury yields briefly eased after a report from the Institute for Supply Management revealed that U.S. manufacturing shrank more than economists expected last month. Many companies cited ongoing tariff disruptions as a major source of chaos. One chemical products company told the Institute, "Too much uncertainty for us and our customers regarding tariffs and the U.S./global economy," noting that orders had weakened across most product lines.

This unexpectedly weak manufacturing data could give the Federal Reserve more leeway to cut its main interest rate at its upcoming meeting, potentially marking the first rate cut of the year. Traders are widely anticipating such a move, though upcoming economic reports could still sway the central bank’s decision. The highlight of the week is expected on Friday, when economists predict a report will show that U.S. employers modestly increased hiring last month. The previous month’s disappointing jobs report had already heightened concerns about the economy and increased expectations for a Fed rate cut.

Not all sectors suffered equally. Constellation Brands, known for its beer, wine, and spirits, saw its stock tumble 6.6% after warning of a slowdown in purchases of its high-end beers, particularly among Hispanic customers. The company slashed its profit forecast for the fiscal year, underscoring the challenges facing consumer brands in a choppy economic environment. Kraft Heinz fared even worse, with shares plunging 7% after the company announced it would split into two separate entities—a dramatic move a decade after the merger that created one of the world’s largest food conglomerates. One new company will focus on shelf-stable meals and brands like Heinz, Philadelphia cream cheese, and Kraft Mac & Cheese, while the other will house Oscar Mayer, Kraft Singles, and Lunchables. The official names for the two spinoffs are expected to be released later.

On the brighter side, PepsiCo managed to buck the trend, rising 1.1% after Elliott Investment Management revealed it had sent recommendations to PepsiCo’s board aimed at reaccelerating growth and boosting financial performance. Elliott has a reputation for buying stakes in companies and pushing for significant changes that often lead to improved stock performance.

By the closing bell, the S&P 500 had fallen 44.72 points to 6,415.54, the Dow Jones Industrial Average was down 249.07 points at 45,295.81, and the Nasdaq composite lost 175.92 points to end at 21,279.63. The Associated Press reported that market jitters were not confined to the U.S.: European indexes slumped as well, with Germany’s DAX dropping 2.3%. In Asia, results were mixed—Seoul’s index rose 0.9%, while Hong Kong’s slipped 0.5%.

Looking ahead, investors and policymakers alike are bracing for a critical week of economic data releases and central bank decisions. With bond yields rising and uncertainty swirling around tariffs, debt, and the Fed’s next move, the market’s path forward is anything but clear. One thing is certain: Wall Street’s resilience will be tested as it navigates the crosscurrents of global finance, politics, and economic policy.

As the week unfolds, all eyes will be on Friday’s jobs report and the Federal Reserve’s response to the latest economic signals. Until then, the only sure bet seems to be continued volatility—and perhaps a little more gold in investors’ portfolios.