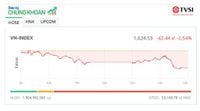

On September 9, 2025, Vietnam’s stock market was gripped by a wave of pessimism as the VN-Index tumbled more than 42 points, closing at 1,624.53. This sharp drop, one of the five worst single-session declines since the start of the year, sent a chill through investors and analysts alike. The negative sentiment was palpable across trading floors, as sector after sector—banking, securities, real estate, and more—succumbed to intense selling pressure.

According to a summary from Chứng khoán Phú Hưng (Phu Hung Securities), the index’s close with a large red candlestick, following a previous session’s decline, confirmed a short-term correction signal. The index fell below its momentum-supporting threshold around 1,645 points, with growing trading volume indicating active selling. "The support area near the psychological 1,600-point mark may slow the decline, but any rebound is likely just technical," the company cautioned. Phu Hung warned that if the index slips below 1,590, risks of a deeper correction toward 1,540–1,550 emerge, while resistance on any recovery sits around 1,670–1,680.

The day’s trading began with a feeble attempt to hold the 1,645-point mark, but as the afternoon session wore on, selling pressure intensified. The focus of this sell-off was clear: banking, securities, and real estate blue chips bore the brunt. By the final 30 minutes, the VN-Index had shed nearly 30 points, culminating in a 2.55% drop for the day. According to BSC Securities, the market breadth was overwhelmingly negative, with 16 out of 18 sectors in decline. The oil and gas sector led the losses, closely followed by industrial goods and services. BSC noted, "VN-Index dropped from the morning session opening, closing at 1,624.53 points, down 42.44 points compared to the previous session."

On the main HOSE exchange, just 56 stocks managed gains while a staggering 285 declined. The number of stocks hitting their floor price was nearly half the number of advancers, a clear sign of panic selling. Trading volume soared, with over 1.9 billion shares changing hands—up 12.4% in volume and 8.9% in value from the previous Friday. The total value reached nearly 53,170 billion VND, evidence of investors rushing to the exits.

Within the VN30 group of large-cap stocks, the pain was acute. Only HPG eked out a modest 0.3% gain, while 26 others fell, some dramatically. VPB closed at its floor price, TPB dropped nearly 6.1%, and other banking stocks dragged the index lower. According to market data, VPB and VCB together wiped out nearly 8.5 points from the VN-Index. The securities sector fared no better, with VIX, VDS, ORS, and EVS all closing at floor prices, while VCI, CTS, and BSI each lost more than 6%. Even mid- and small-cap favorites like HAG, VIX, and CII saw huge volumes traded at their daily limit-down prices, with large unsold orders left on the books.

The carnage was not limited to HOSE. On the HNX exchange, the HNX-Index fell 9.1 points (3.24%) to 271.57, as selling pressure overwhelmed the market. Of the HNX30 group, not a single stock finished in the green—TVD and VC3 merely managed to hold their reference prices. Real estate stock CEO plunged 8.1%, while others like TIG and IDJ also posted steep losses. The session saw 143 decliners against just 35 advancers, with total matched volume exceeding 176.5 million shares worth over 4,018 billion VND. The pattern was similar on the UPCoM board, where the index dropped 1.52% and banking and securities stocks led the retreat.

Foreign investors were a rare bright spot, net buying on HSX and UPCoM, though they sold on HNX. Still, their activity was not enough to stem the tide. Meanwhile, on the derivatives market, the VN302509 futures contract fell 45.1 points (2.4%) to 1,800, with more than 333,970 contracts traded. Even the previously resilient covered warrants market saw a sea of red, despite CHPG2406 bucking the trend with a slight gain.

Technical analysts across the major brokerages were in rare agreement: the market’s short-term outlook is grim. Vietcap Securities forecasted that the VN-Index would continue to test the support zone around 1,600 (+/-10) points on September 10, 2025. "High selling pressure and a violation of the short-term uptrend structure will cause the VN-Index to continue adjusting toward the 1,600-point support area," the firm advised, adding that conditions were not favorable for reopening short-term positions as supply remained strong across most sectors.

Adding to the chorus, TPS Securities observed a clear double top pattern—often an ominous technical signal—accompanied by negative momentum divergences. "The correction is likely to continue in the short term, with the downside target potentially as low as 1,511 points," TPS stated. However, they also noted that 1,600 remains a near-term support level and could offer a brief technical rebound. TPS cautioned, "This is only a short-term opportunity for investors to reduce holdings or restructure portfolios to safer levels."

Yuanta Vietnam echoed these warnings, stating, "The market may continue its downward trend in the next session, and the VN-Index may retest the 1,600 support level. Short-term risks remain high, so investors should not attempt to catch the bottom." The firm also pointed out that sentiment indicators had sunk back into pessimistic territory, reinforcing the need for caution.

It’s not just technicals and sector-wide selling that are weighing on the market. The breadth of the decline was striking: energy, real estate, consumer, technology—no corner was spared. On the HNX, real estate names like CEO, TIG, and IDJ suffered outsized losses, while securities stocks such as SHS, MBS, and BVS all fell sharply. Even in the typically more resilient UPCoM market, banking and securities stocks like BVB and ABB posted losses of 7.4% and 5.4%, respectively.

Despite a brief midday rally driven by steel stocks and a flicker of hope for a reversal, the late-session deluge of sell orders dashed any optimism. The technical break below the MA20 moving average, coupled with surging liquidity, confirmed that a short-term downtrend had taken hold. Still, some analysts maintained that the medium-term uptrend remains intact—at least for now.

With the VN-Index teetering near crucial support and negative sentiment dominating, all eyes are on the 1,600-point threshold. Should that level give way, analysts warn, the next stop could be as low as 1,500. For now, investors are being urged to exercise caution, avoid hasty bottom-fishing, and focus on managing risk while the storm runs its course.