On April 5, 2025, domestic gold prices in Vietnam experienced a significant decline, mirroring a similar downward trend in global gold prices. This marked a notable shift in the market, as prices fell by more than 1 million VND per tael, which is a substantial drop for investors and consumers alike.

At around 10:00 AM local time, the price of gold rings at Bao Tin Minh Chau was reported at 97.5 - 100.5 million VND per tael for buying and selling, reflecting a decrease of 1 million VND on the buying side and 1.1 million VND on the selling side compared to the previous day's closing price. Meanwhile, DOJI Group listed its round plain rings at approximately 96.7 - 100.1 million VND per tael, while Phu Quy Investment Gold reported prices at 97.1 - 100.3 million VND per tael.

Notably, SJC, a major player in the gold market, listed its gold bars at 97.1 - 100.1 million VND per tael. This represented a drop of 1.7 million VND on the buying side and 1.2 million VND on the selling side from the closing price on April 4, 2025. The buying-selling spread for domestic gold is currently quite high, estimated at around 3 million VND per tael, which raises short-term investment risks for those looking to buy gold.

Globally, the gold market also faced pressures, with prices fluctuating around 3,037 USD per ounce at one point on April 5, 2025. This was a decrease of about 65 USD per ounce within the past 24 hours. If converted to the Vietcombank exchange rate, each tael of world gold is priced at approximately 95 million VND. Over the week, the global gold price has seen a reduction of 2% compared to the end of the previous week, and it has lost nearly 4.5% from its recent record peak.

Experts attribute the current decline in gold prices to a combination of factors, including escalating trade tensions that have prompted investors to liquidate gold holdings to cover losses in other asset classes. Additionally, the strengthening of the US dollar has exerted further downward pressure on gold prices, making it less attractive as a safe-haven asset.

The sharp decline in gold prices has sparked discussions among investors and market analysts regarding the future of the gold market. Some believe that this downturn could be a temporary adjustment, while others are more cautious, warning that continued economic instability could lead to further fluctuations.

As the market adjusts, many investors are left wondering whether now is the right time to buy or sell gold. The current landscape presents both challenges and opportunities, and the decisions made in the coming days could have significant implications for investors.

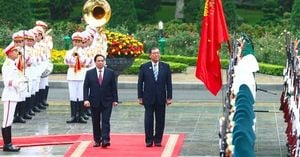

In the context of Vietnam, the government has been proactive in addressing economic challenges. Prime Minister Pham Minh Chinh recently signed a directive aimed at implementing comprehensive and effective measures to combat livestock and poultry diseases. This initiative reflects the government's commitment to maintaining stability within the agricultural sector, which is crucial for the overall economy.

In summary, the gold market is currently experiencing a notable downturn as prices fall sharply both domestically and globally. Investors are advised to carefully consider their options in light of the current market conditions, as the landscape remains volatile.