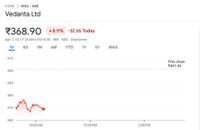

MUMBAI – Shares of diversified resources company Vedanta Ltd (NSE: VEDL) faced intense selling pressure on the National Stock Exchange (NSE) of India during the morning trading session on April 7th. As of 10:17:24 AM UTC+5:30 (India Standard Time), Vedanta stock was trading significantly lower at ₹368.90. This marked a substantial drop of ₹32.55 per share, translating to a steep 8.11% loss for the day thus far. The stock opened well below its previous closing price of ₹401.45.

The intraday chart reveals volatility in the first hour of trading, with the price initially trying to stabilize before succumbing to further downward pressure, falling below the ₹370 level around the time of the data snapshot. This sharp decline positions Vedanta among the notable losers on the Indian market in early trading, highlighting significant negative sentiment impacting the resources giant’s stock price today.

Shares of Anil Agarwal-owned mining conglomerate Vedanta Ltd have now experienced a three-day decline exceeding 18%. The stock is down another 7% on Monday, April 7, having declined nearly 9% last Friday and 4% last Thursday. With this fall, the stock has now corrected nearly 30% from its 52-week high of ₹526, although it remains 15% above its 52-week low of ₹317.

On the charts, the stock has slipped below all of its key moving averages, including the 50, 100, and 200-Day Moving Averages, after this recent fall. The stock has also entered oversold territory, with its Relative Strength Index (RSI) falling to levels of 26, indicating that the stock is at oversold levels.

Recently, Vedanta announced a delay in its demerger timeline, pushing it back to September 2025, citing regulatory approvals. The plan is to split the existing business into five different, independent, listed entities. Shareholders will receive one share of every demerged entity for each share they hold of the currently listed company.

Vedanta's decline aligns with a broader downturn in metal stocks amid rising fears of a recession in the U.S. Metal stocks have been on a downtrend despite a correction in the U.S. Dollar, which is generally favorable for them.

Among the 15 analysts covering Vedanta, nine maintain a "buy" rating on the stock, five suggest holding, and one recommends selling. ICICI Securities currently has the highest price target for Vedanta at ₹605, followed by Emkay at ₹575 and IIFL Institutional at ₹570. Kotak has the lowest target on Vedanta at ₹465, and the stock is trading below all of these levels.

In addition to these market dynamics, the continued imposition of a 25% U.S. tariff on steel and aluminum is likely to drive up domestic prices in the American market, undermining global competitiveness. As exporters from countries such as Vietnam, South Korea, and Japan shift their focus to alternative markets like India and the Middle East, Indian manufacturers are now contending with a wave of low-cost imports. This influx is intensifying pressure on local producers, who are already struggling with shrinking margins and fluctuating production levels.

A previous note by Jefferies highlighted that while the U.S. accounts for just 4% of India’s steel exports, it remains a key sentiment driver—especially for companies like Hindalco. This is due to its subsidiary, Novelis, which contributes around 13–15% of Hindalco’s consolidated EBITDA through its U.S.-focused operations.

Domestic brokerage Nuvama projects a modest 2% year-on-year growth in Nifty 50 earnings for Q4FY25, with the full-year FY25 EPS growth estimate reduced to 6%, down from the earlier forecast of 8%. This downgrade reflects continued earnings softness, sluggish revenue growth, and escalating global uncertainties—particularly concerns surrounding the impact of U.S. tariffs.

Nuvama stated that the sectors on which it is underweight include Industrials, metals, IT, power, and PSU banks. For Vedanta, the brokerage expects the company to post a 2% sequential drop in EBITDA for Q4FY25, primarily due to a mixed trend in metal prices. While aluminum prices rose marginally by 0.8% quarter-on-quarter, zinc prices fell by 7%, impacting overall realizations.

The report estimates Q4FY25 revenues at ₹3,78,196 million, down 3% QoQ but up 7% YoY. EBITDA is forecast at ₹1,08,346 million, showing a 2% decline QoQ, and core PAT is projected at ₹35,381 million, largely flat from the previous quarter. Higher alumina costs are expected to raise the aluminum cost of production (CoP) by 5%, while zinc CoP may decline another 2%. Segment-wise, Nuvama anticipates EBITDA to fall by 2.6% for aluminum, 2.1% for power, and 4.2% for oil & gas, while Zinc India and Zinc International may post modest increases of 0.2% and 1.8%, respectively.

As the market grapples with these developments, investors are left to navigate a landscape fraught with uncertainty. With Vedanta's stock now trading at ₹379, it has erased all the gains of 2025 and is currently down 15% this year. The volatility in stock prices reflects broader economic concerns, particularly as global markets react to changing tariffs and economic forecasts.