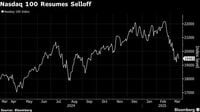

On March 19, 2025, U.S. stocks surged after the Federal Reserve concluded its two-day policy meeting with no change to interest rates but signaled a brighter outlook with potential cuts expected later in the year. The S&P 500 gained 1.1%, closing at 5,675.29, while the Dow Jones Industrial Average added 0.9% to finish at 41,964.63. Similarly, the tech-heavy Nasdaq jumped 1.4%, coming in at 17,750.79, marking a significant recovery from recent downturns.

The rally came in response to Federal Reserve Chairman Jerome Powell, who reassured anxious investors by stating there was no immediate need for drastic measures regarding the ongoing tariff disputes initiated by former President Donald Trump. Powell described the potential effect of tariffs on inflation as likely “transitory,” a sentiment that resonated well with investors who were holding their breath amid economic uncertainties. Christian Hoffmann of Thornburg Investment Management captured the moment with a lighthearted remark, suggesting, “Start making T-shirts: ‘Transitory: We are so back!’”

With the S&P 500 edging up 60.63 points, Powell's address evidently soothed nerves among market players. His comments about recession risks not being high helped alleviate fears that have often gripped the market in recent weeks, especially during periods of heightened cross-asset volatility.

The stock market recovery was also aided by positive sentiment surrounding growth stocks like Nvidia and Tesla, which exhibited gains of 2.7% earlier in the day. The bullish momentum in these companies highlights a broader revival in tech stocks, reflecting renewed investor confidence and a belief that although economic conditions remain uncertain, opportunities still exist.

On the bond front, the benchmark 10-year Treasury note slipped about 3 basis points, closing near 4.26%, indicating that investor sentiment is tilting toward equities rather than fixed income assets at this juncture. Some analysts attributed the shifting landscape to Powell’s commitment to manage monetary policy vigorously in the coming months, signaling an intent to maintain a balance between supporting economic growth while controlling inflation.

In addition to encouraging stock performance, Powell indicated that the Fed would commence reducing its balance sheet at a slower rate starting in April 2025, allowing the central bank a more measured approach to its asset holdings. Jamie Cox from Harris Financial Group noted, “The Fed indirectly cut rates today by taking action to reduce the pace of runoff of its Treasury holdings,” suggesting that these measures could become more apparent as inflation data stabilizes in the upcoming months.

The optimism surrounding potential rate cut actions is palpable, with a 60 basis point reduction anticipated by July 2025. Investors are closely watching the Fed's moves, particularly since the outlook for inflation suggests that a rate cut could support broader economic growth, stimulating consumer spending and investment.

Markets continued to adjust to the Fed’s decisions throughout the day, with futures for the Dow rising 0.16%, the S&P 500 up by 0.29%, and Nasdaq up 0.38% by mid-morning. Strong enthusiasm in the tech space persisted amid these developments, highlighting how dynamic the market remains.

However, despite these optimistic indicators, experts warn that there are still headwinds, particularly stemming from consumer sentiment that appears to be souring. Apollo Global Management Chief Economist Torsten Slok pointed out that consumer fears around job security have reached levels typically associated with recessionary periods. He noted, “A record-high share of consumers think business conditions are worsening,” underscoring the vigilance needed as uncertainties persist in the economic outlook.

The Fed's meetings are anticipated to set the tone for market expectations in 2025, particularly as the release of economic forecasts and other indicators play a pivotal role in shaping perceptions far beyond domestic borders. Analysts are not only keenly observing domestic indicators such as inflation and unemployment but also the broader implications on international markets, especially in light of ongoing geopolitical situations.

As the day wrapped up, the Fed's commitment to navigating economic pressures without tying its hands to strict monetary policies has instilled a sense of cautious optimism. Investors, eager for a clearer direction, remain focused on how fiscal policies will continue evolving in response to both domestic and global economic challenges.