On April 9, 2025, the US stock market experienced significant fluctuations as the Dow Jones Industrial Average opened low, trading at 37,513.92, down by 131.67 from the previous day’s close. This decline followed China’s announcement of retaliatory tariffs aimed at the US, heightening fears of escalating trade tensions between the two economic giants.

China declared it would impose an additional 50% tariff on all imports from the US, bringing the cumulative tariff rate to a staggering 84%, which includes an existing 34% tariff. This move is seen as a direct response to the Trump administration's recent implementation of a cumulative 104% tariff on Chinese goods, which took effect on the same day.

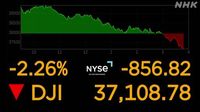

The market opened with a sharp decline, with the Dow falling more than 300 points shortly after trading began. Investors were already on edge due to a series of losses in the previous trading days, where the Dow had plummeted approximately 4,500 points over four days. The long-term interest rate in the US bond market also reached 4.51%, marking the highest level since late February, further contributing to the negative sentiment among investors.

Despite the gloomy start, there were signs of recovery as some tech stocks began to rise. Major players like Apple and Nvidia saw an uptick in their stock prices, providing a glimmer of hope amidst the turmoil. Other Dow components, including Walmart and Microsoft, also showed positive movement, while pharmaceutical stocks like Merck and Amgen faced declines, likely influenced by President Trump’s announcement of new tariffs on imported medications.

On April 8, the situation had been slightly different. The Dow closed at 37,645.59, down 320.01 points from the previous day. Initially, the market saw a temporary rise of over 1,400 points, fueled by optimism regarding negotiations between the Trump administration and various countries concerning tariff measures. However, this optimism quickly dissipated when the White House confirmed plans to raise tariffs on China, leading to renewed fears of an escalating trade war.

As the market reacted to these developments, the NASDAQ Composite Index, which includes a significant number of technology stocks, also experienced a decline, closing down 335.35 points at 15,267.91. This marked a troubling trend for investors, as the index is heavily weighted towards tech companies, which are often sensitive to changes in trade policies.

The recent fluctuations in the stock market have raised concerns among analysts and investors alike. Many are worried that the ongoing trade friction could lead to a broader economic downturn. Market participants had hoped that the mutual tariffs, which President Trump suggested could be negotiated, would not escalate further. However, the administration's firm stance on increasing tariffs has left many feeling uneasy about the future.

Some experts believe that the rapid rise in long-term interest rates, coupled with the uncertainty surrounding trade relations, could lead to a more cautious approach from investors. "The increase in tariffs has created a climate of uncertainty that is weighing on investor sentiment," said one market analyst. "If these tensions continue, we could see more volatility in the markets in the coming weeks."

As the market continues to react to these developments, the focus remains on how the Trump administration will navigate its trade policies with China and other nations. Investors are keenly watching for any signs of progress in negotiations that could alleviate some of the pressure on the markets.

In summary, the US stock market is currently navigating a turbulent landscape marked by fears of escalating trade tensions, rising tariffs, and increasing interest rates. While there are pockets of resilience among certain stocks, the overall picture remains one of caution as investors brace for what may come next.