In a week marked by uncertainty and volatility in U.S. equities, the S&P 500 index has shown signs of resilience but remains down 8% year-to-date. As of April 15, 2025, the index slipped 0.2%, reflecting a relative lull in market-moving global trade developments. Despite this minor decline, analysts are closely watching the market dynamics as they unfold.

On Tuesday, the Dow Jones Industrial Average lost 0.4%, while the NASDAQ ended the session with a negligible loss of less than 0.1%. The fluctuations have been largely attributed to the ongoing tariff situation and its implications for corporate profits. President Donald Trump’s recent tariff announcement on April 2 included import taxes that were significantly higher than many had anticipated, raising concerns that these costs could slow sales across various sectors.

Peter Armitage, CEO and co-CIO of Anchor Capital, commented during a recent webinar that investors might find opportunities if the S&P 500 drops below 4,500 points. He stated, “You can easily see the market up or down 10% over the course of the next few weeks.” Armitage indicated that if the index fell below 5,000, Anchor would consider buying selective shares, suggesting that the market could be on the brink of a significant shift.

Market analysts have observed that the NASDAQ 100, which has been fluctuating around the 19,000 level, faces resistance that may be difficult to overcome. Observers believe that the index is testing a previous uptrend line, with sideways action more likely than a definitive move in either direction. The Dow is currently hovering around the 40,500 mark, with a potential breakout above 41,000 that could lead to a target of 42,000. Conversely, a breakdown below 39,000 could see the index tumble to 37,000.

As the S&P 500 remains relatively flat at approximately 5,400, analysts are keeping an eye on bullish behavior that could push the index towards the 5,600 target. However, if the index breaks down from current levels, support is expected at 5,200 and 5,000.

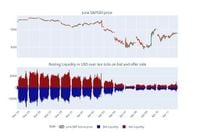

The volatility in the market is further compounded by liquidity concerns. A report from Global Trading revealed that the liquidity of e-mini-S&P 500 index futures experienced a dramatic collapse in order book depth in the two weeks leading up to April 11. From March 24 to March 28, liquidity on the bid and ask was around $250 million to $350 million, but this dropped significantly after the introduction of tariffs on April 2, leading to a liquidity drought that saw available futures liquidity decline to as low as $100 million by April 3.

Despite the challenges, trading volumes have surged, with contracts traded rising by more than 60% between March 25 and April 7, indicating a heightened demand for liquidity amidst the volatility. However, the overall sentiment remains cautious as many investors grapple with the implications of the recent tariff announcements and their potential impact on corporate earnings.

In the backdrop of these developments, stocks such as Netflix saw a notable uptick, with shares jumping 4.8% ahead of the streaming giant's quarterly earnings report scheduled for April 17. Analysts have reported that Netflix aims to double its revenue by 2030, a bold target that has fueled investor optimism.

Conversely, shares of Albemarle, the world's largest lithium producer, tumbled 5.9% as analysts reduced their price targets amid a challenging macroeconomic backdrop. Concerns over trade tensions and their impact on global sales in the automotive sector have led to a cautious outlook for the company, which has been a key player in the battery component market.

Palantir Technologies also made headlines with its stock surging 6.2% after reports surfaced that NATO acquired an artificial intelligence military solution developed by the firm. This strategic move has positioned Palantir as a significant player in the defense technology space.

However, not all stocks fared well. Shares of Molina Healthcare fell 3.8% following a downgrade by analysts who cited uncertainties in the managed care and healthcare facilities industries, particularly regarding Medicare Part D programs.

As the market navigates these turbulent waters, investors are left to ponder the potential for recovery. The S&P 500 recently suffered its first 'death cross' since 2022, a technical indicator that occurs when the 50-day moving average crosses below the 200-day moving average. Historically, such signals have preceded periods of significant market weakness, raising concerns among analysts about the potential for further declines.

Unemployment rates have also crept up to 4.2%, with companies announcing 497,000 layoffs last month, the highest figure for the first quarter since 2009. This increase in unemployment, coupled with concerns about inflation and the impact of tariffs, has led to speculation that the U.S. economy may be heading toward stagflation or recession.

Despite a recent 10% rise from intraday lows, the S&P 500 remains vulnerable, with analysts warning that the current valuation may not support sustained gains. The forward price-to-earnings ratio of the S&P 500 is about 19, still above the 10-year average of 18.3, indicating that earnings estimates may need to be adjusted downward as the earnings season progresses.

As Wall Street braces for a wave of earnings reports, the outlook remains uncertain. Jamie Dimon, CEO of JPMorgan Chase, remarked, “You're going to hear a thousand companies report, and they're going to tell you what their guidance is. My guess is, a lot will remove it.” This sentiment underscores the cautious approach many investors are taking as they navigate a complex and rapidly changing market landscape.