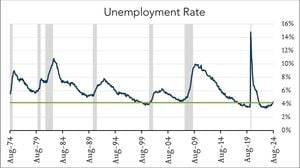

The U.S. labor market is showing intriguing signs of stability, which might just be the calm before the storm as the Federal Reserve navigates through complex economic waters. Recent data releases have analysts and economists on edge, setting the stage for anticipatory reactions heading toward big job reports and Federal Reserve policy updates.

On October 25, the dollar index experienced a noteworthy rise, aiming to secure its fourth straight week of gains. This increase can largely be attributed to factors like revised economic forecasts, which have lessened the urgency around potential interest rate cuts by the Fed. A remarkable bump of 0.18% brought the index to 104.24, reflecting broader market trends, particularly as the euro dipped to US$1.0803.

An uptick in non-defense capital goods orders, excluding aircraft—an important gauge for business spending—rose by 0.5% last month. This marked improvement, exceeding economist expectations, combined with anticipatory behavior from investors, has built substantial momentum leading to the October government payrolls report. This report, due to be released shortly, is expected to reflect impacts from events like Boeing's strike and the recent hurricanes affecting the southeastern United States.

Karl Schamotta, Chief Market Strategist at Corpay based out of Toronto, highlighted this delicate balancing act, stating, “We had a massive recalibration in economic expectations for the US, and the process seems to have largely run its course.” He remarked on the stabilizing interest rate differentials between the U.S. and other major economies, creating space for the Fed to make informed decisions without the constant pressure of fluctuative market sentiments.

Market expectations have shifted drastically over recent weeks. Currently, there's around a 95.6% likelihood of the Federal Reserve proposing a 25 basis-point cut during its next meeting, coinciding with possibilities of holding steady on rates. At the same time last month, predictions were swirling around the likelihood of more aggressive cuts including even 50 basis points.

With these foundational issues playing out, attention is shifting toward the jobs report, which is becoming increasingly pivotal. Investor confidence hinges on the upcoming numbers, which could either reaffirm the Federal Reserve's cautious approach or push it to reevaluate its strategies moving forward.

Looking to Europe for comparative insight, recent reports indicate signs of improvement. A survey reflecting German business sentiment indicated growing confidence among business leaders, signaling optimism amid continued industrial struggles and wavering global demand. European Central Bank President Christine Lagarde reiterated the region's inflation are well-aligned to meet the ECB's 2% target for next year, illuminating potential trajectories on policy adjustments across the Atlantic as well.

For many observers, the January jobs report will be watched closely due to its potential to swing public perception and policymakers’ strategies. Many questions remain whether recent fluctuations were merely statistical anomalies or signposts for larger trends.

The shifts within the U.S. labor market, along with the global economic situation, present unique circumstances for investors, businesses, and citizens alike. With changing rates and potential tariff policies looming under the specter of political outcomes (like those related to Donald Trump's candidacy), the next boardroom discussions will largely feed off these impending figures.

Investors, too, recognize the delicate dance between data, expectation, and reality. The looming discussions surrounding worker pay, labor conditions, and job creation will factor heavily not just on Wall Street, but at the dining room tables of average Americans.

Overall, as the U.S. economy wrestles with uncertainties, including inflation, labor shortages, and geopolitical pressures, all eyes remain peeled on upcoming economic indicators, particularly the payroll report, which will likely shape policy conversations across the floor of the Fed.