On March 12, 2025, the US Department of Labor announced the Consumer Price Index (CPI) figures for February, which saw an increase of 2.8% compared to the same month last year. This figure slightly fell below analysts' expectations of 2.9%, which has led to mixed reactions in financial markets and economic discussions across the nation.

Marking the lowest month-on-month increase at just 0.2%, the CPI showcased some encouraging signs as inflation slows down compared to the previous months. February’s rise reflects the alarming yet fluctuative economic nature as inflation has been consistently monitored for spikes, fearing the possibility of stagflation – when inflation coexists with economic stagnation.

Core CPI, which strips out the often volatile food and energy sectors, increased by 3.1% year-on-year and also saw a 0.2% bump month-on-month. This core inflation number was also below expert forecasts, which anticipated it to reach 3.2%. Notably, this marks the lowest level seen since April 2021.

Experts had begun adjusting their economic forecasts leading to the announcement of these CPI figures. The predictions also coincide with uncertainties stemming from previous tariff implementations under the Trump administration, which are yet to be fully integrated within the pricing model for many imported goods.

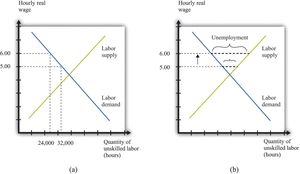

With rising rent contributing significantly to the overall CPI index, which rose by 0.3% month-on-month, some costs, such as airfares and gasoline prices, helped temper the impact of the housing costs by decreasing slightly by 4.0% and 1.0%, respectively. This alleviated some concerns amid rising costs but demonstrated just how sensitive the economy is to fluctuations caused by external factors.

The Atlanta Federal Reserve's growth model indicated on March 6, 2025, projected economic growth at -2.4% for the first quarter of this fiscal year which has raised eyebrows across the financial sector. Such grim predictions for the economy have stimulated concerns about potential recession signs, more so as tariffs continue to stoke uncertainty among consumer spending and businesses.

Despite the tepid CPI growth figures, markets responded by fluctuated positively, with the S&P 500 index futures rising over 1% following the announcement. A thawing reaction varied across different sectors as investors sought opportunities amid the still-volatile market environment.

Recent inflation expectations seem to have been noted as being higher based on consumer surveys, yet the actual CPI figures seem to reflect otherwise, providing temporary relief to many investors and consumers alike. Experts suggest potential shifts observed could lead to stabilization, which may garner hope for the future.

Goldman Sachs has adjusted its forecasts for core CPI growth upward, changing its prediction from 2.4% to 2.9% for Q4 2025, reflecting concerns over potential inflationary pressures resulting from tariffs and broader global economic shifts.

Looking at these figures, the future actions of the Federal Reserve are now being closely watched. There’s speculation about whether they may keep interest rates steady through uncertain economic horizons; traders currently predict there is about a 68% chance they will hold the Federal Funds rate at its current level between 4.25% and 4.50% during the upcoming Federal Open Market Committee (FOMC) meeting slated for May.

Chair Jerome Powell noted earlier at the monetary policy forum, “The American economy is fine,” implying there's no immediate need for aggressive policy shifts, even as inflation remains above the desired targets set by the Federal Reserve.

The recently released CPI data has sparked various discussions on whether or not inflation trends are stabilizing before facing future geopolitical factors influencing market dynamics. The continued monitoring of inflation readings will remain central as businesses and consumers navigate through the remnants of previous policies.