As President Donald Trump marks his 100th day in office, the U.S. economy is showing signs of significant distress, raising concerns about a potential recession. The economy contracted at an annual rate of 0.3% in the first quarter of 2025, following a robust growth rate of 2.4% in the last quarter of 2024. This downturn, noted in a report from the Commerce Department, marks the first time the economy has shrunk since the beginning of 2022, prompting fears that the nation may be on the brink of a recession.

Economic indicators reveal a troubling landscape: personal spending, which is a key driver of the economy, grew at an annual rate of just 1.8% during the first quarter, less than half the pace of the previous quarter. Meanwhile, consumer confidence has plummeted to its lowest level since the COVID-19 pandemic began, with many Americans expressing concerns that Trump's tariffs will lead to higher prices and further economic instability.

"At the end of the day, recession is about a loss of faith," said Mark Zandi, chief economist at Moody's Analytics. He emphasized that as consumers lose confidence in their job security, they tend to cut back on spending, which can lead to a recession. Currently, the unemployment rate stands at 4.2%, but expectations about the job market are the worst since 2009, as indicated by a recent survey from the Conference Board.

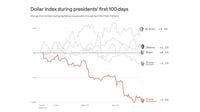

Trump's administration has implemented sweeping tariffs, including a 10% tax on nearly all imports and a staggering 145% tariff on many goods from China. These tariffs are intended to protect American industries but have also sparked fears of rising consumer prices and a slowdown in economic growth. The S&P 500 index has dropped 7.3% since Inauguration Day, while the tech-heavy Nasdaq has seen an 11% decline, marking the worst performance at the start of a new presidency since the 1970s.

In response to these economic challenges, Trump has attempted to reassure the public by announcing a 90-day pause on many of his reciprocal tariffs and exempting several Canadian and Mexican shipments from 25% duties. However, these measures have not assuaged the fears of many economists and consumers alike. "The sentiment data, at least for now, has lost all its meaning," said Joseph LaVorgna, chief economist of Nikko Securities America, who previously held the same title at the National Economic Council during Trump’s first term.

Despite the negative indicators, some economists remain cautiously optimistic. They point to recent job growth, with employers adding 228,000 jobs last month, and retail sales rising by 1.4%. However, these figures may be misleading, as they could reflect consumers frontloading purchases in anticipation of higher tariffs. Ryan Sweet, chief U.S. economist at Oxford Economics, noted that while the consumer is still in relatively good shape, the looming tariffs could ultimately impact their purchasing power.

The recent surge in imports, driven by businesses stockpiling goods ahead of the tariff implementations, has created an imbalance that significantly impacted the GDP. The goods deficit reached a record $162 billion, contributing to the economic contraction. Lindsay James of Quilter Investors remarked, "Thanks in part to companies stockpiling imports, the 0.3% contraction reported today comes as no surprise. However, given it is only the first reading, there is a chance it could be revised down further yet."

As forecasters analyze the likelihood of a recession, opinions are divided. Nearly 40% of economists surveyed by the National Association of Business Economics believe there is a greater than 50% chance of a downturn. The rapid changes in tariff policies make traditional economic indicators less reliable, leading some experts to rely on real-time data reflecting consumer and business behavior.

While some businesses have been adversely affected by the tariffs, others see potential benefits. Tom Barr, a mold maker in Michigan, noted that the tariffs have opened up opportunities for him to attract customers who are looking to bring jobs back to the U.S. He stated, "Somebody reached out to us from Ford Motor Company. They’re investigating it. They’re not saying they’re going to do anything, but they want to know what their options are. So without these tariffs, those phone calls wouldn’t even have taken place."

However, the overall sentiment remains cautious, with many Americans worried about the future. The University of Michigan’s consumer sentiment survey revealed that the share of Americans expecting unemployment to rise over the next year is the highest since 2009. Such data typically foreshadows economic downturns, and experts warn that the current economic climate is precarious.

As the situation continues to evolve, the impact of Trump's tariffs on consumer prices and overall economic health will remain a critical focus. The uncertainty surrounding trade policies, combined with fluctuating consumer confidence, paints a complex picture of the U.S. economy as it navigates through these turbulent times. Economists will be watching closely to see if the administration's measures can stabilize the economy or if the nation will indeed face a recession by the end of the year.