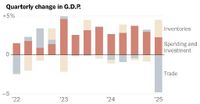

The U.S. economy shrank at a 0.3% annual pace from January through March of 2025, marking the first decline in three years. This downturn is attributed largely to President Donald Trump’s trade wars, which have disrupted businesses and altered consumer behavior. The contraction in gross domestic product (GDP) reversed a 2.4% gain in the previous quarter, raising concerns over the economic outlook as the nation grapples with rising inflation and sluggish consumer spending.

According to the Commerce Department, the decline was primarily driven by a surge in imports as businesses rushed to bring in foreign goods ahead of impending tariffs. Imports grew at an astonishing 41% pace, the fastest since 2020, which shaved five percentage points off the first-quarter growth. Meanwhile, consumer spending slowed sharply, growing at only 1.8% compared to 4% in the last quarter of 2024. Additionally, federal government spending fell by 5.1% in the first quarter.

The financial markets reacted negatively to the GDP report, with the Dow Jones Industrial Average tumbling 400 points shortly after the figures were released. The S&P 500 and Nasdaq composite also saw declines of 1.5% and 2%, respectively. This reflects a broader unease among investors regarding the impact of Trump's trade policies, which have been characterized by erratic announcements and significant tariffs, including a staggering 145% on Chinese imports.

Despite the negative growth figures, some economists suggest that the underlying strength of the economy remains intact. A category of GDP data that measures the economy’s core strength rose at a healthy 3% annual rate from January through March, indicating that consumer spending and private investment are still robust, excluding volatile components like exports and government spending. However, the uncertainty surrounding Trump's tariffs has created a precarious economic environment.

“We think the downturn of the economy will get worse in the second half of this year,” warned Carl Weinberg, chief economist at High Frequency Economics. “Corrosive uncertainty and higher taxes — tariffs are a tax on imports — will drag GDP growth back into the red by the end of this year.”

As the Federal Reserve continues to combat inflation, which rose at an annual rate of 3.6% in the first quarter, policymakers face a dilemma. The Fed’s preferred inflation gauge, the personal consumption expenditures (PCE) price index, increased from 2.4% in the fourth quarter to 3.6% in the first quarter. Excluding food and energy prices, core PCE inflation rose to 3.5%, up from 2.6% previously. The central bank aims to keep inflation around 2%, and these rising figures complicate its strategy.

In a social media post, President Trump downplayed the negative GDP reading, attributing it to the previous administration and urging his supporters to “be patient.” He claimed that the tariffs would stimulate economic growth and that companies are moving into the U.S. in record numbers. However, many economists disagree with this optimistic outlook, citing the potential for further economic decline as the effects of tariffs become more pronounced.

April job growth also painted a concerning picture. Payroll provider ADP reported that only 62,000 jobs were added in April, significantly below expectations and down from 147,000 in March. This slowdown in hiring may indicate that businesses are becoming more cautious about expanding their workforce amid the economic uncertainty. Nela Richardson, chief economist at ADP, remarked, “Unease is the word of the day. It can be difficult to make hiring decisions in such an environment.”

The chaotic start to Trump's second term has led to a fluctuating economy, with consumers and businesses reacting to a barrage of tariff announcements and policy changes. The first-quarter GDP decline, while partly a result of statistical quirks, reflects real changes in consumer and business behavior. Many rushed to purchase goods before tariffs took effect, leading to a significant increase in imports and a corresponding drop in domestic production.

In March, the United States imported nearly twice as many goods as it exported, resulting in a record trade deficit. This imbalance has significant implications for the economy, as sales of American-made goods abroad bolster GDP, while foreign purchases detract from it. The surge in imports during the first quarter was driven by consumers and businesses stockpiling products ahead of the tariffs, complicating the economic picture.

Looking ahead, economists express concerns that the current economic weakness may signal further downturns in the future. Tara Sinclair, director of the Center for Economic Research at George Washington University, noted, “We are seeing a dramatic change in people’s behavior, similar to what we saw during the shock of the pandemic. They’re front-loading purchases they might’ve made later in the year, and that’s very concerning for future quarters.”

As consumer confidence wanes and inflationary pressures mount, the outlook for the U.S. economy remains uncertain. Many Americans are beginning to pull back on nonessential spending, with consumer spending growth slowing to 1.8% in the first quarter from 4% in the previous quarter. Mark Zandi, chief economist at Moody’s Analytics, cautioned, “The consumer is the key to the outlook, and if the consumer starts to pack it in, we’re going into recession.”

In the wake of these developments, the Trump administration faces increasing scrutiny over its economic policies. Senate Minority Leader Chuck Schumer has called for Trump to “admit his failure and reverse course,” emphasizing the need for a more stable economic environment. With the potential for further tariffs and ongoing uncertainty, the economic landscape may continue to shift dramatically in the coming months.

As the nation reflects on the first quarter of 2025, it becomes clear that the interplay between trade policies, consumer behavior, and economic growth will be pivotal in shaping the U.S. economy's trajectory. The challenges ahead are formidable, but the resilience of the American economy remains a key factor in navigating these turbulent times.