The U.S. dollar has experienced significant fluctuations in recent days, driven largely by the implications of newly imposed tariffs by the Trump administration. While economic theory suggests that higher tariffs should strengthen a country’s currency, the reality following the announcement has been quite the opposite, with the dollar's value plunging amid rising recession fears.

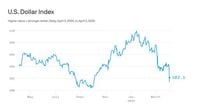

On Thursday, April 3, 2025, an index that tracks the value of the dollar against six major currencies fell to 102.1, marking a sharp decline. The following day, it bounced back slightly to 103, but this was still lower than before the tariffs were unveiled. This decline in the dollar’s value reflects growing investor concern about the potential for a recession in the U.S., as well as worries that U.S. policies may render the country a risky investment in the long term.

Joseph Gagnon, a senior fellow at the Peterson Institute, noted that investors had anticipated a rise in the dollar following the tariff announcement. He explained, "The idea that tariffs make the dollar more valuable has been part of economic theory for 100 years." A 2019 study by the International Monetary Fund corroborated this, finding that tariffs generally do increase the dollar's value in the short term.

However, the current situation appears to defy this expectation. The magnitude of the tariffs has spooked markets, leading to a broader pessimism that has weakened the dollar. Gagnon elaborated, "When U.S. growth is negative and the rest of the world’s growth is positive, the dollar weakens on average," as highlighted in a recent Goldman Sachs note. This sentiment is echoed by Chris Turner, ING's global head of markets, who stated, "The blowback of U.S. tariffs onto the U.S. domestic economy leaves the dollar naked."

As the situation unfolds, traders at Access Bank reported that tariff impositions on Nigeria’s exports to the U.S. have triggered increased demand for the dollar, particularly from foreign portfolio investors. They anticipate potential intervention from the Central Bank of Nigeria to stabilize the naira and curb further depreciation.

In the broader context, the dollar's recent performance also reflects changes in the Canadian market. Following the tariff announcement, the USD/CAD pair sold off aggressively on April 2, 2025. By April 4, the pair experienced a bounce back to 1.4240, a resistance level that had previously held firm. This volatility underscores the uncertainty surrounding currency movements in the wake of tariff-related developments.

Federal Reserve Chairman Jerome Powell acknowledged the ramifications of the tariffs on April 4, stating that they increase the risk of higher inflation and slower growth. His comments came after data showed that nonfarm payrolls rose by 228,000 jobs last month, significantly higher than the forecast of 135,000 jobs. However, the unemployment rate ticked up to 4.2%, raising concerns that the economic landscape is shifting.

On the same day, China announced additional tariffs of 34% on all U.S. goods, set to take effect on April 10, 2025. This escalation in trade tensions has contributed to fears of a recession and intensified the global stock market rout. The euro, which had seen significant gains earlier in the week, dropped 0.95% to $1.10947 on April 4, following an impressive rise of 1.8% the previous day.

The dollar index, which measures the currency against a basket of six major peers, plunged 1.9% on April 3, marking its worst day since November 2022. However, it rebounded by 0.98% on April 4, indicating that while the dollar is facing challenges, it is not without resilience.

Other currencies have also felt the impact of these developments. The Australian dollar hit a five-year low against the dollar, falling 4.42% to $0.60490. The New Zealand dollar also declined, dropping 3.42% to $0.55960, while the Canadian dollar fell 0.81% to 1.4208. Meanwhile, the greenback managed to pare some losses against the yen, trading up 0.58% to 146.92 yen after a significant drop in the previous session.

Market analysts are closely monitoring the situation, with Deutsche Bank warning of the risk of a crisis of confidence in the U.S. dollar. They caution that major shifts in capital flow allocations could overshadow traditional currency fundamentals, leading to disorderly currency moves. As the global economy grapples with the fallout from U.S. tariffs and retaliatory measures from other countries, the future of the dollar remains uncertain.

Overall, the interplay between tariffs, inflation, and economic growth is creating a complex landscape for investors and policymakers alike. With the potential for further tariffs and countermeasures looming, the dollar's trajectory will likely continue to be influenced by both domestic and international developments.