The US dollar continues to remain under pressure against most major currencies as we approach the Federal Open Market Committee (FOMC) decision today. Despite recent signs like higher Core Personal Consumption Expenditures (PCE) estimates following US Consumer Price Index (CPI) and Producer Price Index (PPI) reports, the USD has struggled to find footing.

Market pricing for the Fed shifted from an expectation of more than 80 basis points (bps) of easing by year-end at the height of the risk-off sentiment to roughly 59 bps currently. Interestingly, these adjustments did not lead to a meaningful pullback in the US dollar's selloff. The market is now focused on the FOMC decision due later today, on March 19, 2025, where it's widely expected the Fed will keep rates steady at 4.50-4.75%.

On the other side of the Atlantic, the euro has seen increased strength, attributed to recent news regarding European defense spending. This development particularly boosts the Eurozone as these measures were intended to bolster economic stability. The ECB speakers have also adopted a more cautious tone, warning against cutting rates too swiftly resulting in increased volatility in the EUR/USD exchange rate.

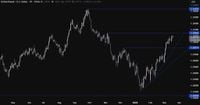

Looking at the technicals, EUR/USD is currently consolidating at the key level of 1.0938. Buyers are hoping to see the price break higher to establish more bullish bets towards the 1.12 handle. If the market experiences a pullback, support appears to be identified around the 1.0767 level where buying interest could potentially emerge again.

Meanwhile, the British pound has enjoyed upward momentum following the increase in EU defense spending, given that the EU is the UK’s largest trading partner. The ongoing data trends continue to pressure the Bank of England (BoE), which is contending with high wage growth and persistent inflation. As a result, the BoE is expected to keep its rates unchanged with a likely 7-2 vote split in favor of maintaining status quo, expecting only two rate cuts by year-end.

For GBP/USD, the pair is trading around 1.30, with the best risk-reward setups for buyers located near the 1.28 support zone. The sellers, however, will look for a break below this support to increase their bearish bets into the 1.26 handle as market sentiment unfolds.

Similarly, the New Zealand dollar remains sluggish with little new data driving market momentum. The Reserve Bank of New Zealand (RBNZ) made a 50 bps cut at its last meeting. Despite initially sounding dovish, Governor Orr reaffirmed a more cautious approach towards easing to align with anticipated neutral rates. The market currently expects a total of 58 bps of easing by year-end, with a 70% probability of a further 25 bps cut at the next meeting.

In analyzing the NZD/USD pair, the recent resistance level seen around 0.5850 signals buyers are looking for a breakout, while sellers are positioned in anticipation of a drop back towards the 0.55 handle if they find confirmation below the aforementioned resistance level.

Simultaneously, the Swiss franc faces its dynamics as the most recent Swiss CPI report exceeded expectations, with core measures maintaining firm growth around 1.00% year-on-year. Economic data indicating a favorable fiscal stimulus from Germany contributes to positive expectations regarding the European and Swiss economies. Despite these trends, the Swiss National Bank (SNB) may be less inclined to push for further rate cuts as the market currently prices a 76% chance of one final reduction at their meeting scheduled for March 20, 2025.

In the USD/CHF technical analysis, a downtrend seems to resurrect, while sellers look to position for a break below the 0.8727 level, enhancing their selling narrative. Conversely, buyers will want to see substantial upward movement to direct targeting towards the 0.90 handle.

As the market prepares for today's FOMC policy announcement, expectations remain cautious. Analysts are eager to see how the Fed will adjust its growth and inflation outlooks. Recent comments from Fed Chair Jerome Powell highlight that "the cost of being cautious is very very low" and that there is currently no need for drastic measures.

The projections and actions regarding quantitative tightening could also shift, with discussions indicating a possible announcement about slowing the run-off pace of Treasury bonds. Additionally, the consensus surrounding the upcoming policy decisions across various central banks creates layers of complexity for traders as they anticipate how economic indicators will influence policy shifts in the near future.

Overall, as the FOMC decision day unfolds, market attention is sharply focused, with traders hanging on each piece of economic data that could further impact their positions in the currency markets.