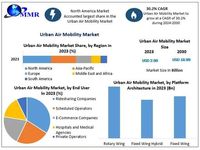

The Urban Air Mobility (UAM) sector is primed for expansive growth, projected to reach USD 18.99 billion by 2030. With rapid urbanization set to see more than 60% of the global population residing within cities by the end of the decade, the demand for innovative transportation solutions has never been greater.

On March 17, 2025, Eve Air Mobility (NYSE: EVEX) and UI Helicopter solidified their commitment to advancing this field by signing a Memorandum of Understanding (MoU) to develop the AAM ecosystem in South Korea. This collaboration aims not only to introduce advanced air mobility technologies but also to address operational standards and regulatory frameworks necessary for successful integration within South Korean urban and rural environments.

“Advanced air mobility has the potential to reinvent global mobility, particularly in the dense urban areas,” stated Johann Bordais, CEO of Eve. “We’re proud to share Eve’s resources in technical and ecosystem development with UI Helicopter to develop a technically rigorous AAM infrastructure.”

UI Helicopter’s CEO, Sungwieh Albert Rim, emphasized the importance of this partnership, noting, “South Korea has been a pioneer... to establish... sustainable infrastructure for the industry to flourish.” The initial step of this collaboration will involve fielding Eve’s Urban Air Mobility market survey, gathering data to support their integration strategy.

The government of South Korea has been proactive in pushing forward UAM initiatives through programs such as the K-UAM Grand Challenge, which seeks to create sustainable air transport solutions. This forward-thinking approach exemplifies the local government’s intent to advance Urban Air Mobility technology, addressing not just the needs of large urban centers like Seoul but also exploring solutions for enhancing connectivity within rural communities.

Meanwhile, the broader low-altitude aviation industry is likewise undergoing significant transformations. Companies like KLARM are reorienting their operations to cater to this booming sector. On the same day, KLARM announced plans for expansion targeting the UAM, drones, and eVTOL manufacturing markets. Jacky, CEO of KLARM, remarked, “The aerospace industry is... at the forefront of this transformation. With our deep expertise in high-precision machining and materials engineering, we are well-positioned to support the next generation of aircraft, drones, and UAM solutions.”

KLARM is investing in next-generation CNC technologies and has increased its production capacity to meet the growing demand for multiple high-precision components necessary for eVTOL aircraft and drones. The company’s advanced machining capabilities utilize 5-Axis CNC machining, micromachining, and hybrid manufacturing to produce components capable of operating under stringent safety and performance criteria.

Investments across the industry are being ramped up as the need for lightweight, high-performance materials surges. With innovations such as improved battery technology and autonomous flight systems, UAM vehicles can now operate more efficiently and sustainably than conventional transport modes. This shift highlights how various stakeholders recognize the need for urgent solutions to urban traffic crises compounded by finite ground infrastructure.

Regulatory bodies are also responding to the urgency of development. The U.S. Federal Aviation Administration (FAA) unveiled new certification standards for eVTOL aircraft back in 2024, streamlining processes for commercial UAM operations. This has ignited interest among operators and investors, evident through partnerships such as Uber Elevate's collaboration with Hyundai, aiming to kickstart commercial air taxi operations by 2025.

The American UAM market is experiencing fierce competition as key players, including Joby Aviation, Archer Aviation, Airbus, and Lilium, vie for market space. With Joby Aviation poised to launch its commercial services soon, the player is gaining traction as it has already secured FAA certification. Archer Aviation, buoyed by its agreements and significant investments, received $1 billion orders to boost its production.

Looking across the globe, the potential for Urban Air Mobility is mirrored by governmental initiatives from Japan and the UK. Japan's "Smart Mobility Challenge" supports the infrastructure needed for eVTOL networks, similar to the UK’s Future of Flight Challenge, which funds vehicle development. Countries like Germany lead pilot projects, and significant players, like Airbus, continue to push the envelope on what constitutes UAM.

Reflecting on the growth trajectories, the emphasis on passenger safety merged with innovations such as digital booking platforms stands out as driving forces behind increased adoption rates, particularly for the passenger transportation segment anticipated to command the largest market share by the end of the decade. Government support, investment influx, and technological advancements have set the stage for the UAM sector to address pressing environmental and urban congestion issues.

Urban Air Mobility is not just about technological development; it’s about rethinking and revolutionizing the transportation sector to enable solutions capable of facing today’s urban challenges. With industry leaders and governments aligned, the prospects for UAM initiatives signal not just growth but the intention to weave UAM systems seamlessly within the fabric of urban transportation solutions, enhancing connections between urban and rural locales and offering sustainable alternatives for the generations to come.