The United Arab Emirates (UAE) has firmly established itself as a significant player in the global gold market, with its thriving gold trade serving as a cornerstone of its economy. In 2019, gold imports to the UAE reached an impressive $20 billion, a substantial increase from the previous year, indicating a robust demand for the precious metal.

According to recent reports, gold prices in the UAE fell on April 23, 2025, with the price for gold standing at 395.16 United Arab Emirates Dirhams (AED) per gram, down from AED 399.15 the day before. The price for gold also decreased to AED 4,609.08 per tola from AED 4,655.61, reflecting fluctuations in the market.

The UAE's gold market is characterized by its diverse consumer base, with jewelry purchases accounting for nearly half of all gold transactions. This trend is primarily driven by cultural preferences and the significance of gold in celebrations and traditions across the region. Institutional investors and banks also play a pivotal role, particularly during economic uncertainty, as they tend to acquire substantial amounts of gold to hedge against market volatility.

Despite its own gold production, the UAE heavily relies on global markets to meet its gold supply needs, with imports primarily sourced from Africa and Europe. The country’s strategic position as a trading hub is further enhanced by its strong infrastructure and supportive governmental policies, which facilitate seamless transactions and foster international trade.

Looking ahead, the UAE's gold market faces various challenges and opportunities. Fluctuations in oil prices and ongoing concerns regarding global economic growth could potentially impact the demand for gold products. Additionally, the ongoing shift from physical gold to digital investments may pose challenges to the UAE’s standing as a leading trading hub for precious metals.

Gold's allure as a safe-haven asset remains strong, particularly during turbulent times. Central banks globally have recognized gold's value, adding 1,136 tonnes worth around $70 billion to their reserves in 2022, marking the highest yearly purchase since records began. This trend underscores gold's role as a hedge against inflation and currency depreciation.

The dynamics of the gold market are also influenced by geopolitical events and economic policies. For instance, recent comments from US President Donald Trump regarding the Federal Reserve have stirred investor sentiment, leading to fluctuations in gold prices. On April 22, 2025, US equity indices rose sharply after Trump stated he had no intention of firing Federal Reserve Chair Jerome Powell before the expiry of his term in May 2026. This announcement contributed to a sense of stability in the markets, prompting some profit-taking around gold prices.

Moreover, the anticipation of a potential resumption of the Federal Reserve's rate-cutting cycle in June has led traders to speculate on how this might affect gold prices. As borrowing costs are expected to decrease, demand for gold, which does not yield interest, may increase, further influencing market dynamics.

The relationship between gold prices and the US dollar is another critical factor to consider. Gold typically moves inversely to the dollar; when the dollar weakens, gold prices tend to rise. As a yield-less asset, gold tends to appreciate in value during periods of lower interest rates, while higher borrowing costs usually exert downward pressure on its price.

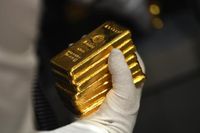

In the UAE, the purity of gold is measured in carats, with pure gold denoted as 24K. While pure gold is malleable and ductile, it is often alloyed with other metals to enhance its durability for jewelry making. This blend not only increases the strength of the gold but also allows for a variety of colors and styles, catering to diverse consumer preferences.

As the UAE continues to navigate the complexities of the gold market, its position as a leading trading hub for precious metals appears secure. The combination of a strong infrastructure, proactive government policies, and a keen understanding of global economic trends will likely ensure the UAE remains at the forefront of the gold trade.

In summary, the UAE's gold market is a vibrant and evolving sector that responds dynamically to both local and global economic conditions. With a strong foundation built on consumer demand, institutional investment, and strategic imports, the UAE is poised to maintain its status as a key player in the international gold trade.