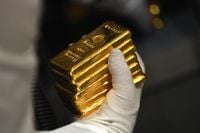

The United Arab Emirates (UAE) has solidified its position as a key player in the global gold trade, with its market dynamics reflecting a blend of local demand and international influences. As of April 17, 2025, gold prices in the UAE remained relatively stable, indicating a steady demand for this precious metal amid fluctuating economic conditions.

Gold prices were reported at 394.77 United Arab Emirates Dirhams (AED) per gram, slightly down from AED 394.80 the previous day. Similarly, the price for gold per tola was AED 4,604.58, showing little change from AED 4,604.87 a day earlier. These prices highlight the ongoing stability in the market, despite external economic pressures.

The UAE's gold market is notably robust, with over a third of its imports consisting of gold reserves. In 2019, the country’s gold imports reached an impressive $20 billion, marking a significant increase from the previous year. This surge in imports is primarily driven by consumer purchases of jewelry, which account for nearly half of all gold transactions in the UAE.

Institutional investors and banks also play a pivotal role in the gold market, acquiring substantial amounts during periods of economic uncertainty or when profit potential arises. This trend underscores the dual nature of gold as both a luxury item and a strategic asset in investment portfolios.

Geopolitical factors and economic fluctuations, particularly in oil prices, are closely monitored as they can impact the demand for gold products in the region. The ongoing transition from physical gold to digital investments poses additional challenges to the UAE's status as a leading trading hub for precious metals.

Despite these challenges, the UAE continues to leverage its robust infrastructure and supportive governmental policies to maintain its competitive edge. The country’s strategic initiatives in international trade further bolster its position in the global gold market.

On the international front, gold has regained its status as a safe-haven asset, particularly in light of recent economic developments. The US 10-year Treasury yield has recently tumbled almost six basis points to 4.281%, reflecting broader concerns about economic stability. This decline in yields typically enhances the appeal of gold as an investment.

Moreover, Federal Reserve Chair Jerome Powell has indicated that the central bank may face challenges in balancing its dual mandate of fostering maximum employment and stabilizing prices. He acknowledged that a weakening economy coupled with high inflation could lead to a stagflationary scenario, potentially impacting gold prices further. “We may find ourselves in the challenging scenario in which our dual-mandate goals are in tension,” Powell stated.

Market analysts are closely watching the Federal Reserve's moves, with expectations of easing monetary policy by the end of 2025. Money market players have priced in 91 basis points of easing, with the first cut anticipated in July 2025. Such monetary policy shifts could significantly influence gold prices, as lower interest rates typically bolster demand for non-yielding assets like gold.

In addition to domestic dynamics, global economic indicators are also shaping the gold market. Recent data revealed that US retail sales rose by 1.4% month-over-month in March 2025, surpassing forecasts. This surge was largely attributed to strong auto sales, although the control group for GDP calculations showed a mere 0.4% increase, missing expectations.

Furthermore, the Federal Reserve reported a decline in industrial production by 0.3% in March, following a previous increase of 0.8% in February. Such mixed economic signals contribute to the uncertainty that often drives investors toward gold.

Central banks are also significant players in the gold market, having added 1,136 tonnes of gold worth around $70 billion to their reserves in 2022, the highest annual purchase on record. Emerging economies, including China, India, and Turkey, are rapidly increasing their gold reserves, further underscoring gold's status as a strategic asset during turbulent times.

Gold's inverse correlation with the US Dollar and US Treasuries adds another layer to its investment appeal. When the dollar depreciates, gold prices tend to rise, making it an attractive option for investors seeking to diversify their portfolios. Additionally, geopolitical instability and fears of recession can prompt rapid increases in gold prices, reinforcing its role as a safe-haven asset.

The purity of gold is measured in carats or karats (symbol/abbreviation K), with pure gold denoted as 24K. However, pure gold is often alloyed with other metals to enhance its durability, as its softness makes it unsuitable for jewelry on its own. This practical consideration reflects the dual nature of gold as both a commodity and a cherished material for adornment.

As the UAE navigates the complexities of the global gold market, its strategic initiatives and robust infrastructure position it well to adapt to changing economic landscapes. The interplay of local demand, international market trends, and geopolitical factors will continue to shape the future of gold trading in the region.

In conclusion, while the UAE faces challenges in maintaining its gold market dominance amid shifts towards digital investments and fluctuating economic conditions, its historical significance and ongoing commitment to the gold trade suggest a resilient future for this precious metal.