On April 3, 2025, the semiconductor industry faced a significant shock as President Donald Trump announced a series of new tariffs that sent shockwaves through the stock market. Major players like Nvidia, Advanced Micro Devices (AMD), and Broadcom saw their stock prices plummet in response to the announcement, raising concerns about the future of chip manufacturing and the broader tech sector.

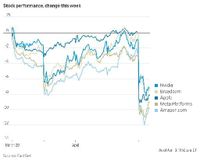

Nvidia's stock fell over 5%, while AMD dropped about 4%. Broadcom experienced a steep 7% decline, and Micron Technology, a key memory chip supplier for Nvidia’s GPUs, also lost 7% in value. TSMC, the Taiwanese giant responsible for manufacturing advanced semiconductors for companies like Nvidia and Apple, sank approximately 5%. This market reaction reflects growing fears about supply chain disruptions and increased costs due to the new tariff measures.

Starting April 5, a 10% baseline tariff will be applied globally. From April 9 onward, reciprocal tariffs will be imposed based on individual countries’ trade practices: China will face a total tariff of 54%, which includes a pre-existing 20% tariff; Taiwan will see a 32% reciprocal tariff; and Vietnam will be subject to a 46% reciprocal tariff. These moves are expected to impact chip imports from these countries, which are major suppliers of AI servers, laptops, and other high-tech products to the U.S.

The U.S. imported around $19 billion in servers equipped with Nvidia GPUs from Taiwan and approximately $34 billion from China in 2024, according to trade data compiled by Michigan State University’s supply chain expert Jason Miller. The new tariffs will likely increase costs for U.S. companies that rely on these imports, potentially slowing demand for AI chips and computing hardware.

Trump has positioned these tariffs as a means to encourage companies to manufacture their chips domestically. He highlighted TSMC’s $100 billion investment in Arizona, an expansion that began under the Biden administration with support from the U.S. Chips and Science Act. However, industry experts are skeptical about the tariffs' effectiveness in reshaping manufacturing strategies. Truist analyst William Stein surveyed ten semiconductor manufacturers and distributors, and none indicated plans to move operations to the U.S. in response to these tariffs. One respondent even suggested that companies are avoiding major investments in new locations due to doubts about the permanence of these tariffs.

Despite the immediate stock drop, some analysts believe that AI chipmakers like Nvidia may weather the storm better than others. Stein noted that AI companies are in an aggressive race to develop Artificial General Intelligence (AGI) at almost any cost, which could mean that demand for Nvidia’s GPUs remains strong despite higher prices. However, the long-term impacts of these tariffs remain uncertain. If they persist, they could lead to increased costs for U.S. tech companies, potential supply chain restructuring, and shifts in global chip manufacturing strategies.

Adding to the tumult, on the same day, HSBC analyst Frank Lee downgraded Nvidia’s stock from buy to hold, citing concerns not just about tariffs but also about Nvidia’s pricing power and the sustainability of AI spending. While most analysts remain bullish on Nvidia, Lee's downgrade highlights the growing worries about the company's long-term growth prospects.

The ramifications of these tariff announcements extend beyond Nvidia. On April 3, 2025, Apple lost $290 billion in market value, while Nvidia itself saw a staggering $183 billion wiped off its market capitalization. Other tech giants were not spared either, with Amazon losing $165 billion, Meta Platforms dropping $104 billion, and Broadcom losing $65 billion. In total, Apple and Nvidia have lost a combined $470 billion in market value, underscoring the broader impact of these tariff measures on the tech sector.

As investors and industry leaders navigate this turbulent landscape, many are left wondering how these tariffs will reshape the semiconductor industry and whether they will lead to a significant shift in manufacturing practices. Will companies be forced to adapt to new economic realities, or will they find ways to mitigate the impact of these tariffs? For now, the tech world watches closely as the situation unfolds, with the potential for further trade actions looming on the horizon.

In light of these developments, investors are urged to reevaluate their portfolios and consider the risks associated with companies heavily reliant on international supply chains. As the semiconductor industry grapples with these new tariffs, the implications for AI technology and the broader tech landscape remain to be seen.