Donald Trump’s return to the presidency has stirred interest, particularly among real estate professionals who are now tasked with deciphering how his administration's anticipated economic and housing policies might shape the U.S. market. Fresh from winning the election, Trump’s stance on tariffs and immigration, among other issues, is likely to impact investment opportunities and market dynamics significantly.

Analysts at RCLCO suggest Trump’s previously suggested goals, which include substantial changes to the economic fabric of the nation, could lead to rapid price growth, presenting both opportunities and challenges. A notable concern is how the U.S. might revert to heightened tariffs, especially on Chinese goods, which could complicate investment strategies across the board.

India, meanwhile, finds itself potentially benefiting from this shifting geopolitical chessboard. With Trump emphasizing ‘friend-shoring’ and near-shoring strategies, other countries, including India and Vietnam, might witness increased Foreign Direct Investment (FDI) as companies look to diversify supply chains away from China. Recent data shows impressive growth patterns for recorded and realized FDI entering Vietnam, with trends indicating stability and upward movement even during global uncertainties.

Looking back at Trump’s first term, during which the U.S.-China trade tensions escalated, Vietnam thrived, gaining traction as companies relocated or expanded their production facilities to mitigate risks associated with over-reliance on Chinese manufacturing. The garment and textiles sectors, along with manufacturing, have shown remarkable resilience, thereby solidifying Vietnam's place on the world economic stage.

Similar sentiments were echoed by real estate analysts who foresee the 2024-2028 timeframe as favorable for Vietnam’s real estate market, driven by the country’s strategic location, affordable labor force, and its growing domestic market receptive to international investments. The anticipated influx of capital from North America and Europe could underpin the commercial real estate sectors, resulting in rising property values and increased market activity.

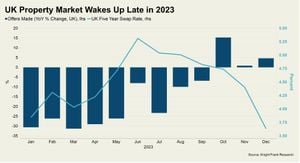

At the same time, the U.S. housing market is experiencing turbulence. Lawrence Yun, chief economist at the National Association of Realtors (NAR), recently indicated the average mortgage rates are projected to settle between 5.5% and 6.5%, considerably higher than the previous administration’s rates. Alongside rising mortgage rates, the overall economic sentiment remains cautious as the nation grapples with budget deficits and inflation pressures.

Yun suggests increasing the home supply to absorb market pressures may help stabilize prices. Notably, this demand for more housing links back to Trump’s potential decisions on tax cuts and how these fiscal policies could directly affect homeowners and prospective buyers.

Current trends also indicate the home sales recovery many sought after did not materialize as anticipated; existing home sales fell short during 2023 and are expected to remain stagnant through 2024, with only slight upticks forecasted for the subsequent years as conditions stabilize. The gap between wealthy homeowners and renters continues to expand, raising concerns about accessibility to housing for younger generations.

Not to be outdone, the Vietnamese market is reacting to these global movements. With its population nearing 100 million and geographical advantages tapping the broader Southeast Asian market of around 675 million people, Vietnam is positioned as one of the most promising economies worldwide under Trump's administration. Policies aiming to tilt investments toward sectors showing growth, such as healthcare and technology, resonate well with potential investors seeking lucrative avenues for their capital.

Overall, as Trump embarks on his second term, the interconnectedness of real estate, economic policy, and global relations will play out on multiple stages, with countries like Vietnam standing to gain from favorable shifts in U.S. policy. It's yet to be determined how the housing market will react domestically, but there’s no doubt the ripples of Trump's renewed presidency will be felt across many sectors.

Simultaneously, Trump’s presidency is likely to provoke varying sentiments across different segments of the economy. Investors and real estate providers are now more than ever focused on aligning strategies with potential changes prompted by Trump's return —whether adjusting to anticipated trade policies or re-evaluing domestic market conditions under new economic guidance.