President Donald Trump’s recent tariffs on imports from Canada, Mexico, and China are sending shockwaves through the U.S. pharmaceutical industry, prompting warnings of worsening drug shortages and rising health-care costs for American patients.

Last Saturday, Trump announced his administration would impose substantial tariffs, including a 25% tax on nearly all goods from Mexico and Canada and a 10% tariff on imports from China. Though both Mexico and Canada quickly negotiated with the administration and managed to secure a one-month pause on the tariffs, industry experts remain highly concerned about the long-term ramifications of these measures.

The Healthcare Distribution Alliance, which speaks for 40 drug distributors, emphasizes the severe ramifications these tariffs could have on the pharmaceutical supply chains already under duress. "We are concerned..." stated John Murphy III, President and CEO of the Association for Accessible Medicines, highlighting fears about generic drugs experiencing increased prices and potential shortages.

These developments occur against the backdrop of already pressing drug shortages. Many patients across the U.S., particularly those relying on generic medications, have encountered significant obstacles to accessing affordable prescriptions. Notably, generics make up about 90% of U.S. prescriptions; hence, the tariffs have the potential to severely restrict access to affordable treatments.

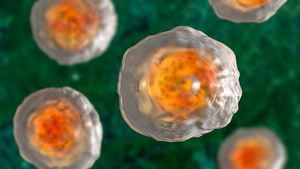

According to experts, the pressing issue lies with the active pharmaceutical ingredients (APIs) sourcing, significantly influenced by global manufacturing locations. Approximately 80% of APIs come from countries outside the U.S., with China being a major supplier. "Generic manufacturers simply can’t absorb new costs..." Murphy reiterated, asserting the thin profit margins—sometimes as low as 0.3%—make it increasingly challenging for those companies to remain viable.

Dr. Aaron Kesselheim, a professor of medicine at Harvard Medical School, stressed the gravity of the situation, noting, “About half of generic drugs people take in the U.S.—including cancer drugs, antibiotics, and blood thinners—are made entirely overseas.” The potential consequences may lead many companies to exit the U.S. market altogether, contributing to the existing crisis of drug shortages.

The uncertainties induced by trade tariffs could exacerbate shortages already affecting medicines like injectable cancer therapies and other essentials, leaving hospitals and patients to contend with rationing some treatments. With increased costs looming as a result of the new tariffs, many fear these expenses will be passed directly down to patients and health-care payers, including Medicare and Medicaid, leading to wider access issues.

Trade associations are lobbying hard against the tariffs on pharmaceuticals, urging the Trump administration to exempt generic drug products from such measures. Murphy emphasized the steep decline of the value of generic drug sales over the past five years by $6.4 billion, adding, “Our manufacturers sell at extremely low prices, sometimes at a loss, and are increasingly forced to exit markets where they are underwater.”

Other sectors of the health care industry are also weighing the impact of these tariffs. For example, medical device manufacturers, including Intuitive Surgical, have expressed concerns about how tariffs could increase the costs of products manufactured abroad, also adversely impacting gross profits.

Industry experts have expressed fears about potential panic-buying among hospitals and pharmacies as they try to stock up on drugs before prices rise. Rena Conti of Boston University pointed out how wealthier institutions may be able to buffer these price increases by increasing their stockpile of certain drugs, leaving smaller, under-resourced hospitals vulnerable when shortages strike.

Arthur Caplan, head of the division of medical ethics at NYU Langone Medical Center, anticipates the tariffs will likely not lead to increased domestic production for generic drugs, as the market is too unprofitable to incentivize manufacturers to establish manufacturing facilities within the U.S. He remarked, “It will take months, but drug prices will increase.”

These tariffs are not merely economic levers but are reshaping the essence of American healthcare, posing potential consequences for both the pharmaceutical supply chain and, critically, the patients who depend on them to manage their health.

With the pressures of rising costs, existing shortages, and the looming uncertainties about their healthcare options, many Americans are left with more questions than answers as the situation develops.