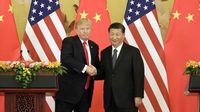

In a dramatic turn of events, U.S. President Donald Trump spent the final hours before the implementation of significant tariffs negotiating with allies, but his insistence on imposing a staggering 104% tariff on numerous Chinese goods has cast a shadow over hopes of averting a trade war. On April 8, 2025, Trump and senior administration officials hinted at the possibility of reaching agreements to lower or eliminate high tariffs affecting multiple countries, signaling a potential shift in strategy amid escalating global tensions.

During an energy conference at the White House, Trump remarked, "We are doing very well in making—I call it a customized deal, not a done deal; this is a very customized deal." However, he remained adamant about enforcing high tariffs on about 60 trading partners, whom he labeled as the "worst offenders." These tariffs were set to take effect shortly after midnight New York time, raising concerns among economic analysts and trade experts.

The looming tariffs have already begun to ripple through financial markets. On April 7, shares of U.S.-listed cryptocurrency companies experienced a significant drop, following a sharp decline in Bitcoin, which fell by as much as 5.5% to its lowest point in 2025. The decline was attributed to heightened tensions in the ongoing trade war, prompting investors to withdraw from riskier assets.

Shares of Strategy, a firm holding billions in cryptocurrency tokens, plummeted more than 10%, while Coinbase and Robinhood saw their stock prices decrease by 5% and 14%, respectively. These declines reflect a broader trend, as both companies have surrendered much of their gains since Trump's victory in the November 2024 presidential election. The cryptocurrency market, which had previously rallied on Trump's promises to establish the U.S. as a crypto capital, is now facing an uncertain future.

Investor Bill Ackman has raised alarms, warning that the U.S. might be heading toward an "economic nuclear winter" as market volatility escalates. This sentiment is echoed by other financial analysts who suggest that the new tariffs, while not directly applied to cryptocurrency companies, are nevertheless impacting the overall market sentiment. "High risk aversion is nullifying optimism about a better environment for coins," stated Susannah Streeter, head of finance and markets at Hargreaves Lansdown.

Despite the turmoil, Bitcoin showed signs of recovery on April 8, gaining 2.59% in a 24-hour period, although it remains down 2.80% for the week. The current price of Bitcoin stands at Rp 1,338,900,823.29, while Ethereum has dipped 0.47% in the past day, reflecting a 13.64% decrease over the week, trading at Rp 26,286,909.10.

Other cryptocurrencies are also experiencing fluctuations. Tether (USDT) slightly increased by 0.72% in the last 24 hours, while XRP rose by 0.77% after a significant weekly decline. The price for XRP is currently Rp 32,162.90 per coin. Binance coin (BNB) saw a modest rise of 1.10% in the past day, trading at Rp 9,387,251.39, while Solana (SOL) strengthened by 3.19%, currently priced at Rp 1,813,480.49.

Meanwhile, USD Coin (USDC) rose by 0.76% in 24 hours, trading at Rp 16,871.52, and Dogecoin (DOGE) increased by 2.49% despite a weekly decline of 9.13%, now valued at Rp 2,534.09. Cardano (ADA) also made gains, rising 4.66% in the last 24 hours, priced at Rp 9,964.94.

As the cryptocurrency market continues to navigate these turbulent waters, analysts urge investors to remain cautious. The overall market capitalization of cryptocurrencies today stands at Rp 42.25 trillion, reflecting a slight increase of 0.68% compared to the previous day. The ongoing uncertainties surrounding tariffs and trade relations are likely to keep investors on edge.

In summary, the combination of President Trump's aggressive tariff policies and the resulting market reactions has created a precarious situation for both traditional and digital assets. As negotiations unfold and the implications of these tariffs become clearer, market participants will need to stay vigilant and informed.