U.S. President Donald Trump has recently taken steps to clarify the future of U.S.-China trade relationships amid rising tensions surrounding tariffs. On March 21, 2025, Trump announced plans to meet with Chinese President Xi Jinping to discuss tariffs as the United States wrestles with a staggering $1 trillion trade deficit with China. During his remarks, Trump expressed, "I have a good relationship with Xi, but we have a $1 trillion deficit with China." This statement underscores the gravity of the discussions to come.

In a broader context of diplomatic negotiations, the U.S. Trade Representative (USTR) representatives are scheduled to meet their Chinese counterparts next week, around March 24. Although specifics on the negotiations remain sparse, the administration plans to use tariffs flexibly as a mechanism to address the growing trade gap. The anticipation surrounding these negotiations reflects a pivotal moment in U.S.-China relations, which have been fraught with tension over the past few years.

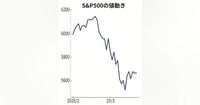

In the financial markets, recent activity suggests a cautious optimism may be returning. On the very day of Trump’s announcement, the S&P 500 index showed signs of rebounding, closing at 5667.56, up 0.1% from the previous day. This signals a potential shift as excessive fears regarding an economic slowdown due to tariff policies began to ease. The Dow Jones Industrial Average also rose, closing at 41,985 dollars, up by 32 dollars.

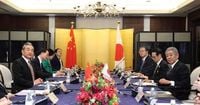

Adding to the complexities of the situation, Japan and China engaged in a high-level economic dialogue on March 22, 2025, to address economic cooperation amid the backdrop of Trump’s tariff enforcement. Chinese Foreign Minister Wang Yi emphasized the need for multilateralism and free trade, stating, "We will uphold multilateralism and free trade" as a counter to Trump’s protectionist policies. This dialogue is particularly noteworthy as it marks the first time in six years that Japan and China have conducted such high-level discussions.

Concerns remain, however, about the repercussions of Trump's tariff policies and the implications for global trade. Wang noted the severe changes facing the world economy, accusing the Trump administration's tariffs of fostering an environment of rampant protectionism that could exacerbate global economic instability.

While Trump’s administration has voiced commitments to regulatory relaxation, the FTC (Federal Trade Commission) has upheld stringent oversight procedures for mergers and acquisitions initiated during the previous Biden administration. FTC Chairman's previous statements indicated that the commission would challenge any mergers it finds economically harmful to the American populace, creating apprehension among companies considering M&A activities. "If mergers economically harm the U.S. people, we will litigate," the Chairman asserted in early 2025, highlighting the FTC's intent to maintain a vigilant stance against corporate consolidations.

As financial institutions like Goldman Sachs anticipate changes in the M&A landscape, their stock prices have shown volatility in response to evolving regulatory conditions. The financial market seems to have mixed expectations, oscillating between optimism from potential M&A activity and caution due to impending tariffs and regulations. Goldman has since pressed the administration to clarify its policy stance, suggesting that clear direction is essential to bolster market confidence.

With Trump resuming office, speculations have surfaced regarding the potential for looser regulatory environments. Still, as recent statements from both U.S. regulatory bodies and international counterparts continue to reveal the complexities entwined in U.S.-China trade dynamics, corporate sentiment remains sour regarding investment activities. As one market participant articulately noted, "We are not in a position for M&A right now."

As discussions continue and both nations seek to navigate through these economically turbulent waters, the actions taken in the coming weeks will undoubtedly have lasting implications on U.S.-China relations. For Japan, maintaining economic cooperation with China while simultaneously standing firm against undue pressure from tariffs presents a fine balancing act. Foreign Minister Iwaya expressed a desire to deepen discussions, stating, "We want to deepen discussions to materialize cooperation on the potential that both countries possess." However, cautious adherence to the economic realities posed by the protectionist environment dictated by Trump's policies remains the pragmatic approach forward.

This situation calls for careful negotiation and collaboration amongst all parties involved, with a clear understanding that maintaining a healthy international trade ecosystem is beneficial to all. The road ahead will require deft diplomacy and economic strategizing to ensure a path toward stability rather than conflict amidst rising tensions over tariffs.