On March 4, 2025, American President Donald Trump ignited significant economic turbulence by imposing new tariffs on the United States' largest trading partners: Canada and Mexico. The tariffs, set at 25%, took effect at 12:01 AM and are seen as part of Trump’s broader strategy to reshape trade relations and tackle illegal immigration alongside fentanyl trafficking.

During statements made at the White House, Trump expressed his finality on the trade measures, stating, "There’s no room left for Mexico or for Canada," indicating no possibility for negotiation to avoid the tariffs. He reiterated this directive as market reactions mounted, signaling fears of heightened inflation and potential retaliatory measures from both neighbors.

The Canadian Prime Minister, Justin Trudeau, quickly condemned the tariffs as "unjustified." He announced plans for retaliatory tariffs on American goods valued at $155 billion, incorporating immediate tariffs on $30 billion worth of U.S. imports, which will take effect shortly after midnight. Trudeau argued, "Due to the tariffs imposed by the U.S., Americans will pay more for groceries, gas, and cars, and potentially lose thousands of jobs," highlighting the negative fallout these tariffs could orchestrate on the economy.

Simultaneously, the Mexican peso depreciated significantly against the dollar, falling to its lowest level since February 3. This decline mirrored the swift reaction of Canada, where the Canadian dollar also faced downward pressure. The Mexican President, Claudia Sheinbaum, is expected to announce her country’s response following news of the tariffs.

Reacting to Trump’s decisions, Canadian Foreign Minister Melanie Jolie indicated Canada’s readiness to impose countermeasures, emphasizing their comprehensive tariff strategy aimed at balancing the economic scales against U.S. imports. She underscored, "These tariffs represent an existential threat for us, with thousands of jobs on the line."">

From the U.S. market perspective, the response to Trump’s announcement was immediate and severe, with the S&P 500 index tumbling 2%, reflecting investors' concerns about rising costs due to trade disruptions. A wide range of businesses, including major corporations like Ford and Walmart, cautioned against the economic repercussions these tariffs could invoke.

Trump’s tariffs come as he has also doubled the existing 10% tariff on imports from China to 20%, adding another layer of complexity to the already tense U.S.-China trade relations. This move is purportedly to address concerns over illegal drug trafficking and is seen as part of his broader agenda to rectify trade imbalances and encourage manufacturing to return stateside.

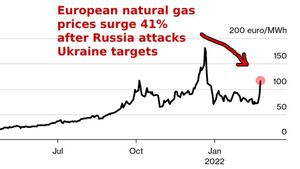

The potential economic ramifications of Trump’s tariffs extend beyond the immediate impacts on Canada and Mexico. Analysts warn of inflationary pressures leading to higher prices for American consumers, with estimates indicating these tariffs could cost the average American household significantly.

Economic experts, including those from the Bank of Canada, have forecasted potential contractions of 3% in the Canadian economy over several years due to retaliatory measures and hindered trade flows. The Mexican government has similarly signaled readiness to respond, raising the stakes for what could escalate to broader trade war dynamics.

Even within Trump’s administration, concerns have been voiced over the long-term effects of these punitive tariffs. Republican Senator Ron Johnson expressed worries, indicating, "You disrupt all kinds of supply chains, and you're likely to increase costs for consumers. There's legitimate concern about this."">

On the international front, China’s immediate announcement of countermeasures against U.S. agricultural imports highlights the global ramifications of Trump's tariffs. The potential escalation of trade tensions may lead to larger geopolitical consequences amid rising protectionism sentiments.

Many expect heightened tensions among the three nations as they maneuver through the realities of these tariffs. Market stability remains uncertain as investors calculate the longer-term impacts of these burgeoning tariffs on overall economic growth.

Looking forward, Trump indicated plans for additional "reciprocal tariffs" based on trade practices from other countries, signaling this tit-for-tat escalation could continue. The global economic environment is becoming increasingly fragile as stakeholders navigate these tumultuous waters.

Overall, the trade measures instituted by Trump have sparked not only immediate changes to currency values, but they also promise extensive transformations to trade relations throughout North America and beyond, presenting new challenges for all primarily involved.