With President Donald Trump returning to the White House for his second term, the focus is set on ambitious economic policies aimed at revamping the U.S. economy by 2025. The administration is preparing to tackle significant fiscal challenges, particularly the expiration of tax cuts established during Trump's first term.

On January 20, 2025, Trump was inaugurated, and with him, the Republican Party maintained slim majorities in both the House of Representatives and the Senate. This political situation presents both opportunities and hurdles for the administration. Trump has already made headlines with his promise to push through substantial tax cuts, which could significantly alter the financial and economic landscapes.

The Tax Cuts and Jobs Act of 2017 provided significant benefits to individual taxpayers and businesses, lowering the corporate tax rate from 35% to 21%. These cuts, set to expire at the end of 2025, have stirred controversy as they could lead to increased taxes for many Americans, prompting urgent action from Congress to renew or extend these incentives.

According to the Trump administration, if Republicans can effectively manage these fiscal cliffs, it could usher in sweeping economic reforms. The timeline for these reforms coincides with several deadlines, including the expiration of more than $400 billion worth of tax cuts and government funding deadlines.

President Trump characterized these tax cuts as central to his economic agenda, stating, "I will do it by unleashing American Energy production, slashing Regulation, rebalancing International Trade, and reigniting American Manufacturing."

These words reflect his administration's broader goal of reviving the economy through deregulation and fostering domestic production.

Fed Chair Jerome Powell, addressing the Federal Reserve’s recent policy decisions, stated, "With the economy remaining strong, we do not need to be in a hurry to adjust our policy stance." His comments come amid Trump's own criticisms of the Fed's handling of inflation, which has remained somewhat elevated, hovering above the central bank's 2% target. Powell maintained his commitment to responding to economic data as it becomes available, emphasizing the need for patience when assessing inflation's future path.

Market analysts continue to express concern about the inflationary pressures stemming from Trump's proposed policies. Economists warn the risk of inflation may rise again as tax cuts and tariffs are introduced, pushing the central bank to be cautious about lowering interest rates too quickly.

Seema Shah, Chief Global Strategist at Principal Asset Management, underlined the unpredictability of the environment, stating, "The reality is the Fed is simply trying to respond to the data and the new administration’s policies as they emerge. Keeping policy rates on hold until a clear direction starts to surface is sensible." This sentiment resonates with many financial experts who caution against impulsive measure-making amid such uncertainty.

Political maneuvering is also expected within Congress as the expiration of these tax cuts looms. Republicans are determined to utilize reconciliation—the budget process enabling them to advance their tax agenda—while avoiding Democratic votes. Yet, even with the arcane process aiding their efforts, political factions within the GOP could complicate decision-making as various lawmakers pursue divergent agendas.

Richard Clarida, former Fed official now at Pimco, noted the two paths before the Fed: one where inflation subsides, allowing for rate cuts; and another where inflation persists, leading to prolonged stable rates. This duality symbolizes the current climate of economic apprehension. Investors reacted accordingly, selling stocks as they braced for potential shifts and uncertainty, with the S&P 500 seeing declines amid speculation of economic policies yet to be implemented.

Trump's administration is not only targeting tax cuts but intends to lean heavily on tariffs as part of its broader economic strategy. On the campaign trail, Trump famously stated, "To me, the most beautiful word in the dictionary is ‘tariff.’" Tariffs would serve as both revenue-raising tools and protectors of domestic industries. Early indications suggest aggressive tariff policies, possibly extending current tariffs and imposing new ones on key trading partners like Canada and China, could disrupt international trade and exacerbate costs for consumers.

Steve Moore, senior economist at the Heritage Foundation, emphasized the relevance of these decisions: "Tariffs will affect not just trade relations but broader economic collaboration and integration. The effectiveness of Trump’s policies will depend heavily on how they’re received at home and abroad."

Even as the administration moves forward with ambitious reforms, the focus will revolve around whether it can find common ground among Republican factions lining up behind different elements of the fiscal agenda.

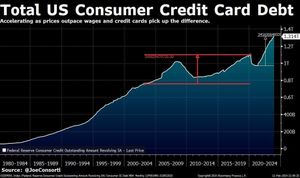

Trump's critics have already expressed concerns about the broader impact of his economic policies on government spending and the deficit. Estimates indicate the complete set of proposed tax cuts could exacerbate the budget deficit, projecting nearly $8 trillion more over the next decade. This would place tremendous strain on the national debt, already nearing $32 trillion. Lawmakers will face complex choices; extending tax cuts without significant reforms could scuttle efforts to control rising fiscal pressures.

Looking forward, it’s clear the Trump administration's plans are ambitious, yet fraught with challenges—from managing potential inflation hikes and political divisions, to grappling with the inevitable consequences of large-scale tax reform. The administration will have to navigate these waters carefully to avoid repetition of past political failures, particularly those related to health care reforms during Trump’s first term.

Trump’s extensive agenda will also mean deep negotiations, and economic outcomes will depend on global recalibrations as the U.S. continues to assert itself on trade and fiscal policies. For now, industry watchers and everyday citizens alike are left waiting, questioning how these economic reforms will reshape the future of American finance.

Keeping the public informed and engaged with clarity will remain at the forefront as these discussions evolve. Given the factors at play, the overarching sentiment suggests caution is warranted until the administration lays out its plans and potential repercussions become clearer.