The second Trump administration is rapidly reshaping U.S. international trade policy, particularly with respect to tariffs, sanctions, and export controls. The pace of these actions has left many businesses struggling to navigate the evolving landscape and prepare for what lies ahead. However, a clearer picture is emerging, particularly regarding export controls, as the U.S. Department of Commerce, Bureau of Industry and Security (BIS) appears poised to follow a roadmap established by key figures within the agency.

James Rockas and Robert Burkett, who now serve as Deputy Under Secretary and Chief of Staff at BIS, respectively, are recognized as authors of the chapter on the Department of Commerce in the Project 2025 Mandate for Leadership publication by the Heritage Foundation. This document outlines a series of proposed reforms aimed at modernizing the Export Administration Regulations (EAR), which govern the export of sensitive technologies and goods.

Among the key priorities for EAR modernization identified in Project 2025 are the elimination of the "specially designed" licensing loophole, the redesignation of China and Russia to more prohibitive export licensing groups, and the tightening of various export control measures. Specifically, the report suggests:

- Eliminating license exceptions

- Broadening foreign direct product rules

- Reducing the de minimis threshold from 25% to 10% or even 0% for critical technologies

- Tightening deemed export rules

- Redefining fundamental research to prevent exploitation by authoritarian regimes

- Improving regulations regarding technology transfers and published information

Some of these proposals may not fit neatly into the existing EAR framework, making it challenging for businesses to anticipate how they will be implemented. However, understanding these potential changes is crucial for organizations that rely on international trade.

One significant change could involve broadening the Foreign Direct Product Rules (FDPRs), which currently extend U.S. export controls to foreign-made items that are the direct product of U.S.-origin technology. In 2020, FDPRs were substantially expanded to target companies like Huawei, and it is expected that new FDPRs will cover critical technologies such as semiconductor manufacturing and artificial intelligence. These changes could result in tighter controls over a wider range of products and technologies.

Another critical aspect of the proposed reforms is the reduction of the de minimis threshold. Currently, a product made outside the U.S. may be subject to export controls if it incorporates more than 25% of U.S.-origin controlled content by value. This threshold varies for certain countries, with some having a de minimis level as low as 0%. Lowering this threshold would significantly broaden BIS's extraterritorial jurisdiction, allowing it to control a larger volume of foreign-made products.

Tightening deemed export rules is also on the agenda. Under existing regulations, sharing controlled technology with foreign nationals is considered an export to their home country, regardless of where the disclosure occurs. This poses challenges for companies employing foreign nationals, particularly from countries deemed a concern, such as China or Russia. The proposed changes could require additional licensing for such disclosures, complicating workforce management and compliance.

In a related development, on April 10, 2025, Landon Heid, President Trump’s nominee for Assistant Secretary of Commerce for Export Administration, testified before the Senate Banking Committee. He indicated that BIS might act "relatively quickly" to apply Entity List restrictions to subsidiaries of listed entities. This move would significantly expand compliance obligations for exporters and technology providers, capturing foreign subsidiaries that have previously escaped licensing requirements.

Heid’s testimony also highlighted broader enforcement priorities, particularly concerning China’s acquisition of artificial intelligence capabilities. He raised concerns about transshipment through jurisdictions like Hong Kong and suggested that BIS may pursue tighter controls to prevent the diversion of advanced technologies.

Meanwhile, on April 25, 2025, the U.S. government initiated a review of the critical minerals sector under Section 232 of the Trade Expansion Act, a move that aligns with the administration's ongoing efforts to bolster domestic production of essential materials. This review follows the invocation of the Defense Production Act in March 2025, aimed at determining policies to enhance U.S. production capabilities in critical minerals.

China's recent actions have added urgency to this review. The mainland has terminated exports of rare earths in response to new export control rules, implementing stricter controls on seven materials vital for electric vehicles and energy storage. Additionally, China has expanded dual-use export controls on various critical minerals, including antimony, graphite, gallium, and germanium.

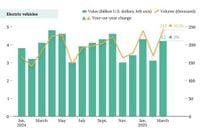

China’s exports of rare earths have been on a downward trend, showing a 24.9% year-over-year decline in March 2025, following a 24.6% drop in February. This decline reflects broader shifts in demand, particularly for electric vehicles, as the country adjusts to its new export control landscape.

The U.S. review of critical minerals will focus on processed materials and derived products rather than raw materials, as the administration seeks to influence supply chains and enhance domestic production. The precise scope of the review will be determined after consultations, but it is expected to encompass a range of materials essential for national security and advanced manufacturing.

In 2023, the Department of Energy identified critical materials for the upcoming decade, which includes not only those on the U.S. Geological Survey list but also other materials like copper and electrical steel. The review aims to refine which materials are included, with applications spanning electronics, energy, and defense sectors.

As the U.S. navigates these complex trade dynamics, companies must remain vigilant and proactive in adapting to the shifting regulatory environment. The combination of Project 2025 and emerging policies from BIS suggests a future where export controls are broader, compliance expectations are heightened, and the operational landscape is more challenging than ever.

In summary, the evolving international trade policy under the second Trump administration signals a significant shift in how the U.S. approaches export controls and critical minerals. Businesses should prepare for a landscape marked by tighter regulations and increased scrutiny as the administration seeks to fortify national security and economic interests.