Thailand's Consumer Confidence Index (CCI) experienced notable variations as it reflects changing sentiments among Thai consumers amid economic fluctuations. The University of the Thai Chamber of Commerce (UTCC) recently published data indicating how consumer confidence evolved as of February 26, 2025, pointing to the importance of this index as both an economic bellwether and guide for future spending decisions.

According to the latest reports, the index fell to -20.5, marking a significant drop from -18.9 the previous month. This decline indicates increasing caution among consumers as concerns over economic stability rise. The index is used as a leading indicator of economic activity; hence its movements can reflect public sentiment about the economy.

Dr. Suthipol Thangsupachai, Director of the Economic Research Institute at UTCC, noted, "Consumer confidence reflects people's spending behavior, which is pivotal for economic recovery." This highlights how consumer sentiment directly correlates with market dynamics.

Several factors have contributed to this downturn. Primarily, rising inflation rates and increasing living costs are placing greater financial strains on households. Dr. Piyaporn Wongruang, an economic analyst at UTCC, has pointed out, "Rising inflation and the cost of living pressures have noticeably impacted consumer sentiment." These statements reflect how external economic pressures play pivotal roles in shaping consumer confidence.

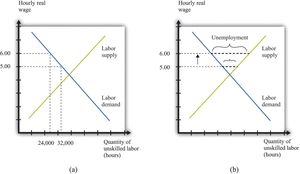

When consumers express low confidence, they tend to cut back on spending, which can create ripple effects throughout the economy. The index's decline signals potential challenges not only for businesses but also for policymakers who look to stimulate growth. Tracking and analyzing these trends will be key to formulating effective economic strategies moving forward.

Economic experts are closely monitoring the CCI to anticipate shifts in consumer behavior. The survey results charted by the UTCC show periods of increasing confidence often coincide with positive forecasts on employment and income stability. Therefore, as economists examine the index, they seek patterns indicative of recovery or continued struggle.

This index emerges not only as mere numbers but as insights transforming economic discussions and decisions. It impacts everything from government policy to corporate strategies, emphasizing the need for responsiveness to consumer needs and expectations.

Overall, the current CCI results serve as both warning signs and calls to action. With many households feeling the effects of economic pressures, boosting consumer confidence will be necessary for fostering spending activity. Continued vigilance and targeted interventions will be required to restore optimism among consumers.

Finally, as Thailand navigates these turbulent economic waters, focusing on consumer needs will remain at the forefront of discussions aimed at reviving the economy. The Consumer Confidence Index is expected to evolve continually, reflecting the ever-changing economic conditions and consumer sentiments. Monitoring its trends and taking appropriate actions can herald shifts toward improved economic landscapes.