The Department of Foreign Trade in Thailand is ramping up its efforts to monitor and regulate the export of 49 products that may falsely claim Thai origin as a response to the United States' recent imposition of a 36% reciprocal tariff on Thai goods. This tariff adjustment has raised eyebrows and concerns among Thai exporters, as it significantly impacts Thailand's export economy.

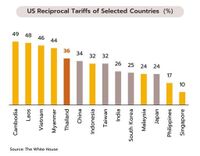

According to Ms. Arada Fuangthong, the Director-General of the Department of Foreign Trade, the U.S. has implemented these tariffs as part of a broader strategy to balance trade with various countries, and Thailand has been categorized among the countries facing the highest import duties. This new tariff rate, effective from April 9, 2025, positions Thailand fifth in ASEAN for tariffs, trailing behind Cambodia, Laos, Vietnam, and Myanmar.

In light of this, the Department has identified 49 specific products for closer scrutiny, which include solar panels, truck wheels, artificial stone slabs, and steel pipes. Exporters must now submit a Certificate of Origin Form (C/O) to confirm that their products genuinely originate from Thailand before being allowed to export. This measure aims to bolster confidence among U.S. customs officials regarding the authenticity of Thai exports.

"The Department of Foreign Trade is closely monitoring the situation to prevent any circumvention of the U.S. tariffs via other countries," Ms. Arada stated. She emphasized the importance of ensuring that exported goods genuinely represent Thai origin to avoid penalties and maintain trade relations.

The reciprocal tariff policy is expected to pose significant challenges for the Thai economy, particularly as the nation grapples with the ongoing impacts of global trade tensions. Research from Krungsri suggests that these tariffs could lead to a stagnation in Thai exports, with projections indicating that growth may hover around 0% for the remainder of 2025 without any negotiations to reduce these duties.

Industries that are likely to feel the brunt of these tariffs include processed seafood, automotive tires, hard disks, electrical appliances, and rubber gloves. These sectors are particularly vulnerable as they rely heavily on the U.S. market, which has historically offered lower import duties for these products.

"The imposition of such high tariffs may lead to a significant decline in exports, which could adversely affect production and employment across these industries," noted the report from Krungsri. Additionally, the analysis warned that the ongoing trade war could exacerbate existing economic challenges for Thailand, which is still recovering from the pandemic.

In a broader context, the impact of the U.S. tariffs on Thailand is compounded by the fact that Thailand's export figures have been inflated by the practice of "zero-dollar" exports, where goods from China are re-exported through Thailand. This practice has raised concerns that Thailand is merely serving as a transit point for Chinese goods, which diminishes the actual economic benefits to the Thai economy.

"This issue of zero-dollar exports is a significant challenge that Thailand must address. While it may boost export figures, it does little to enhance value-added to the Thai economy," stated Sudjai Chanchatreeratan, a columnist who highlighted the need for Thailand to reassess its trade policies in light of these developments.

As Thailand seeks to navigate these turbulent waters, there are calls for a reevaluation of its trade strategies, particularly regarding how it engages with the U.S. and other major markets. Dr. Supavut Chaiwatana, a prominent economic advisor, emphasized that Thailand must adapt to the realities of the Trump administration's trade policies and not simply rely on historical trade relationships.

"We must develop new strategies that align with the current global trade dynamics, including increasing our agricultural imports from the U.S. to balance trade deficits and enhance our position as a quality food processor for global markets," Dr. Supavut suggested.

Moreover, the recent fluctuations in the Thai baht have added another layer of complexity to the situation. The baht has appreciated significantly against other currencies, which could further impact Thailand's export competitiveness. Analysts from KKP Research noted that the currency's strength, driven by factors such as tourism revenue and global economic conditions, may ultimately hinder the ability of Thai products to compete in international markets.

"If the baht continues to strengthen, it may lead to a scenario reminiscent of 'Dutch disease,' where the economy grows from natural resources but suffers from a lack of competitiveness in manufacturing due to high currency value," they warned.

Looking ahead, the Thai government is under pressure to stabilize the economy and protect its export sectors from the adverse effects of U.S. tariffs and currency fluctuations. The Department of Foreign Trade is committed to working closely with U.S. customs officials to ensure compliance and foster a more favorable trade environment.

As Thailand grapples with these challenges, the focus will remain on maintaining the integrity of its exports while adapting to the shifting landscape of global trade. The hope is that through careful monitoring and strategic adjustments, Thailand can navigate this complex situation and emerge with a more resilient economy.