On the morning of September 11, 2025, Thailand’s trade landscape took a dramatic turn as the country’s Ministry of Commerce, in collaboration with the Customs Department and the Department of Special Investigation (DSI), launched a sweeping investigation into the import of polypropylene plastic. The probe, which began promptly at 10:00 AM, aims to scrutinize the legality and procedures surrounding the importation of this crucial industrial material—a move that could have far-reaching consequences for manufacturers, exporters, and the broader plastics industry across Southeast Asia.

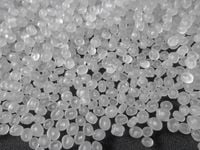

The focus of the investigation is squarely on polypropylene plastic products, identified under a slew of HS (Harmonized System) codes, including 3902.10.30.001, 3902.10.30.090, 3902.10.40.001, 3902.10.40.090, 3902.10.90.001, 3902.10.90.090, 3902.30.30.001, 3902.30.30.090, 3902.30.90.001, 3902.30.90.090, and 3902.90.90.000. According to the Thai Ministry of Commerce, the investigation covers a three-year period of import activities, stretching from 2023 back to 2020, and is designed to clarify the import process while ensuring full compliance with national and international trade laws.

The catalyst for this high-profile probe was a formal complaint lodged by three major Thai plastics producers: HMC Polymers Co., Ltd., Thai Polyethylene Co., Ltd., and IRPC Public Company Limited. These companies presented what the Department of Foreign Trade (DFT) described as "sufficient evidence" of a sharp increase in polypropylene imports. The numbers are striking: import volumes soared from 228,365 tons in 2020 to 390,583 tons in 2023—a staggering 71.03% jump. The upward trend continued into the following years, with 297,871 tons imported in the first three quarters of 2024, rising to 351,764 tons in the same period in 2025, marking an 18.09% increase year-on-year.

The DFT, which is leading the investigation alongside the Customs Department and DSI, says this surge in imports is not just a matter of numbers. The department contends that the increase has either caused or threatens to cause serious injury to Thailand’s domestic polypropylene industry. The evidence, according to the DFT, is visible in declining market share, falling sales, reduced production, lower capacity utilization rates, and mounting losses among local producers. The investigation is tasked with determining whether these adverse effects are directly linked to the spike in imports, and if so, whether safeguard measures are justified.

In a statement released to the public, the DFT emphasized the gravity of the situation: "The increase in imports has caused or threatens to cause serious injury to Thailand’s domestic production, as reflected in the decline in market share, sales, production, capacity utilization, and increased losses." (as reported by moit.gov.vn). This sentiment is echoed by industry insiders, who worry that unchecked imports could undermine the competitiveness of Thai manufacturers and jeopardize jobs in a sector that forms the backbone of the country’s industrial economy.

The investigation is not being conducted in a vacuum. Importers, exporters, and other interested parties have been invited to submit written evidence, documents, opinions, and comments regarding the case. The deadline for submissions from parties within Thailand is 4:30 PM ICT on September 24, 2025, while foreign exporters and interested parties have until October 1, 2025, to make their voices heard. The DFT has provided detailed contact information for those wishing to participate, including phone numbers and email addresses, underscoring the department’s commitment to transparency and due process.

Vietnam’s plastics association and related manufacturing/exporting companies have also been advised to monitor the situation closely and, if necessary, submit relevant data and commentary to the Thai authorities. The Ministry of Industry and Trade in Vietnam has warned that if Thailand imposes safeguard measures, Vietnamese polypropylene producers and exporters could face significant challenges, potentially disrupting trade flows and raising costs for businesses on both sides of the border.

The ongoing investigation is not just about numbers and regulations—it’s about the livelihoods of thousands of workers, the health of a vital domestic industry, and the delicate balance of regional trade relationships. As the DFT noted, "If safeguard measures are implemented, the production and export of polypropylene will face greater difficulties. Therefore, providing information to the investigative agency... will help to prove whether the increase in imports is sudden and/or whether the increased imports are the cause or threat of serious injury to domestic production." (moit.gov.vn)

Industry experts say the stakes are high. Polypropylene is a versatile plastic used in everything from packaging and automotive parts to textiles and consumer goods. A disruption in its supply chain—or a sudden imposition of tariffs or quotas—could ripple through countless sectors, affecting prices, availability, and the competitive landscape. For Thai manufacturers already grappling with global economic headwinds, any additional barriers could be especially painful.

On the other hand, some importers and international suppliers are concerned that the investigation could lead to protectionist measures that stifle competition and raise costs for downstream industries. They argue that rising imports are driven by legitimate market demand and that domestic producers should focus on innovation and efficiency rather than relying on government intervention. As one industry observer put it, "The investigation should be thorough and fair, but it must not become an excuse for unnecessary trade barriers that ultimately hurt consumers."

The DFT has assured all stakeholders that the investigation will be conducted with the utmost professionalism and impartiality. The department has encouraged all relevant parties to participate fully, warning that failure to provide information could result in decisions being made based on incomplete or unfavorable data. In the words of the DFT, "Failure to provide information will force the investigative agency to rely on available information (which is often not beneficial) to prove the necessity of safeguard measures." (moit.gov.vn)

As the deadline for submissions approaches, the Thai business community is watching closely, aware that the outcome could set a precedent for how the country handles similar trade disputes in the future. The investigation is expected to take several months, with authorities reviewing all evidence before making any recommendations or decisions regarding safeguard measures.

For now, the only certainty is uncertainty. The investigation into polypropylene imports has cast a spotlight on the complex interplay between trade, industry, and regulation in Thailand. As companies, workers, and policymakers await the next steps, one thing is clear: the stakes could hardly be higher for those whose livelihoods depend on the outcome.