Krungsri Bank recently concluded its "Krungsri Exclusive Economics and Investment Outlook" seminar, which focused on the multifaceted economic horizon and investment strategies for 2025. The event gathered insights from economic experts, emphasizing the need for strategic investments as the global economy continues to face uncertainties.

Dr. Pimnara Hirankajorn, who leads the economic research team at Krungsri, presented key forecasts, indicating, "The global economy will grow more than last year, but still below pre-COVID averages." This highlights the recovery efforts yet to reach the normalcy seen before the pandemic. Factors influencing this growth include advancements in artificial intelligence (AI), shifts in fiscal and monetary policies, and the far-reaching effects of Donald Trump's tax policies on the Thai economy.

Experts discussed not only the positive aspects of these perspectives but also potential risks. The U.S. economy, Dr. Hirankajorn noted, is anticipated to experience economic slowdowns, evident from the declining rate of job growth outside agriculture and instability indicated by fluctuated consumer confidence levels, which are now showing signs of unease.

Ms. Catherine Tong, Vice President and Product Strategist at PIMCO, added more layers to the bond investment narrative, stating, "Investing in bonds remains attractive amid volatility due to high yields and potential interest rate cuts." Her points underscored the undeniable allure of bonds within unpredictable market environments, thereby appealing to potential investors seeking stability.

Nevertheless, all eyes remain on how the Federal Reserve will respond to shifting economic dynamics, as it has been suggested the central bank could initiate several interest rate cuts, estimated at about two to three times moving forward. This prospect underlines yet another layer of uncertainty, with Ms. Tong emphasizing the strategic benefits for those who invest at high yield levels to maximize long-term returns.

On the international front, the impact of Trump's economic policy reforms was highlighted by Mr. David Wong from AllianceBernstein. He cautioned, "The impacts of Trump's new policies could lead to mixed results for investments moving forward," encapsulating the tension investors feel as they navigate these uncertain waters. The challenges posed by potential trade barriers and economic fragmentation can influence both U.S. and Thai markets.

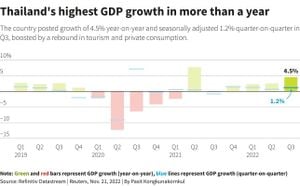

The seminar also shed light on Thailand’s economic forecast for 2025, with expectations of growth propelled by factors such as increased government expenditures, which are anticipated to rise by approximately 4.2%, along with soaring tourism numbers. These elements are predicted to provide some stability and growth momentum, pointing to optimism even amid potential global downturns.

Mr. Wirat Wittayasereethada, Krungsri's head of investment strategies, noted, "We are at a good time for bond investments due to political uncertainties and the downward trend of interest rates." His view places emphasis on not just adapting to current market conditions but actively seeking opportunities to capitalize on these shifts. Investment strategies, particularly those focused on bonds, will likely perform well during periods defined by high volatility.

Nonetheless, he cautioned against complacency, highlighting important structural issues within Thailand's economy, such as high household debt levels impacting consumer spending and investment capabilities. These, combined with the external pressures of fluctuated commodity costs and changing market demands, could temper the anticipated growth.

The overarching sentiment from the seminar suggested cautious optimism about the upcoming year, intertwining proactive investment strategies with careful monitoring of economic indicators. Stocks outside of the renowned tech giants, with attractive valuations and growth potential, emerged as focal points for investors eager to diversify their portfolios.

More than ever, the resonance of the Krungsri seminar encapsulated the necessity for vigilance and adaptability as Thai investors choreograph their strategies against the backdrop of global economic turbulence. With multifaceted insights offered by industry leaders, the foundation is laid for informed decision-making as the year 2025 approaches.