Tesla, Inc. (NASDAQ: TSLA) is making significant strides in the electric vehicle (EV) market as it prepares to launch in Saudi Arabia on April 10, 2025. This move marks a pivotal moment for the company as it enters a region traditionally dominated by gasoline-powered vehicles. The launch event will take place at the Bujairi Terrace in Riyadh, where Tesla plans to showcase its popular EVs, solar energy solutions, and cutting-edge battery technologies. Attendees can expect demonstrations of its autonomous driving technology with the Cybercab, alongside the introduction of Optimus, Tesla's humanoid robot, which highlights the company's advancements in artificial intelligence and robotics.

The initial response to Tesla's Saudi launch has been overwhelmingly positive, with considerable interest from potential buyers. This enthusiasm stands in stark contrast to the backlash the company has faced in parts of the U.S., Canada, and Europe, where its vehicles and facilities have recently been targeted by vandalism and arson. The Saudi market presents a promising opportunity for Tesla, with annual passenger vehicle sales nearing 700,000 units, predominantly favoring SUVs.

Historically, the Saudi Arabian market has been challenging for electric vehicles due to the country's heavy reliance on oil. However, recent policy shifts have encouraged EV adoption, including tax exemptions, subsidies, and the establishment of charging stations. This change is expected to bolster Tesla's growth in the region. Notably, Tesla's entry into Saudi Arabia follows Lucid Motors (LCID), which has already set up a factory in the country with backing from the sovereign wealth fund, indicating a significant interest in EV production and adoption.

In addition to its Saudi expansion, Tesla is also looking to grow its presence in India, another key market for electric vehicles. The company plans to begin by selling cars as direct imports and has partnered with Tata Motors for global component supply. These initiatives reflect Tesla's commitment to global expansion and its efforts to address challenges stemming from slowing vehicle sales.

On the stock market front, Tesla shares closed higher on March 25, 2025, marking the fifth consecutive session of gains. The stock rose 3.5% to finish at $288.14, a recovery from the two-month selloff that had seen shares drop significantly. Despite this recent uptick, Tesla's stock remains approximately 40% down from its record high set in December.

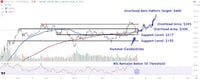

The recent gains come after an all-hands meeting where CEO Elon Musk urged employees to retain their Tesla shares, asserting that Wall Street does not fully appreciate the company's value, particularly in relation to its self-driving technology and robotics products. Analysts have noted that the stock's recent performance is noteworthy, especially as it has formed two bullish hammer candlesticks on its weekly chart, suggesting a potential reversal in momentum.

Technical analysis of Tesla's stock reveals key areas of overhead interest around $300, $385, and $680. Should the stock continue to rise, it is anticipated that the $300 mark will attract significant interest, as it aligns with a trendline connecting major swing highs from January 2021 to July 2023. Further upside could trigger buying interest near the $385 area, while a move into price discovery mode could push the stock towards $680.

Conversely, important support levels are identified around $217 and $155. A loss of momentum could see the shares decline to the $217 level, which may provide support near this month’s low. If selling resumes, lower support around $155 could present buy-and-hold opportunities for investors.

As analysts assess Tesla's prospects, the consensus rating for TSLA stock stands at a Hold based on 14 Buys, 11 Holds, and 11 Sells assigned in the last three months. With an average price target of $335.32, analysts suggest a potential upside of 16.37% from current levels. This outlook reflects a cautiously optimistic view on Tesla's ability to navigate market challenges and capitalize on new opportunities.

In summary, Tesla's upcoming launch in Saudi Arabia represents a significant milestone in its global expansion strategy, as the company seeks to establish a foothold in a market ripe for EV adoption. With supportive government policies and growing consumer interest, Tesla is well-positioned to make an impact in the region while also addressing its challenges in other markets.