On March 10, 2025, the New York Stock Exchange faced significant turmoil as major technology stocks plummeted amid growing apprehensions over the U.S. economic slowdown. This decline was particularly marked for industry leaders, with Apple and Tesla experiencing notable drops.

At approximately 11:37 AM Eastern Time, Apple’s stock price fell by 5.06%, settling at $226.98. During the trading session, it dropped even lower to $225.29, the lowest valuation since January 27, 2025, when it hit $223.98. Along with this drop, Apple's market capitalization shrunk to approximately $3.049 trillion.

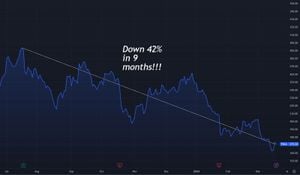

Meanwhile, Tesla’s stock suffered even more severely, decreasing 8% to $241.66. This price was below the closing value of $251.44 noted on the day before the U.S. midterm elections, which took place on November 5, 2024, and less than half of its peak price of $479.86 from December 17, 2024. Tesla’s stock had already sustained over 10% losses the previous week, marking its longest consecutive weekly decline since its IPO back in June 2010. By the afternoon, the drop escalated to over 13%, reflecting investor anxiety over its continuing poor performance.

The causes behind this market downturn can be tied directly to concerns surrounding the economic impacts of tariff policies initiated by President Trump. The president had reinforced these concerns following his remarks during a recent Fox News interview, stating, “(These matters have) transitional phases. What we are doing is bringing wealth back to America, and achieving this (goal) takes some time.” His comments suggested the administration’s acknowledge of potential economic turbulence as necessary for long-term prosperity.

Just as significantly, other big-name tech stocks also faced declines. Meta Platforms, hit by the current environment, registered a 4.45% drop to fall below $600, effectively breaking from 20 consecutive days of growth. Other major companies, including Nvidia (-3.63%), Alphabet (-3.97%), Microsoft (-3.08%), and Amazon (-2.04%), ranged between 3-5% decline as well, drawing attention to widespread distress across the sector.

Stock market analysts have posited the development as driven by unrealistic market expectations following two years of substantial tech stock gains, primarily fueled by advancements and investments centered around artificial intelligence. But the mood on Wall Street shifted dramatically as these fears of inflation and broader economic strain began to seep back, transitioning investor sentiment toward caution.

Adding fuel to the flames, Tesla’s struggles seemed multifaceted. Elon Musk’s increasingly right-leaning political stance has alienated core segments of its consumer base, contributing to declining sales not just domestically but also impacting markets abroad, including China and Europe. Analysts suggested this fallout could be pushing the stock down as investors began to reassess the company's stock as aligned with political turbulence associated with the Trump administration.

The financial industry was not spared. Other sectors, including banking stocks, also plummeted on fears of rising bad debts, reflecting the bleak economic outlook. JP Morgan, the largest U.S. bank, fell by 4.94%, or $11.97, to $230.31, and Goldman Sachs dropped $33.12, losing 5.91%, concluding at $526.54. Similarly, Citigroup and Wells Fargo reported declines due to rising concerns about their future profitability.

Overall, the events on March 10, 2025, highlight the fragility of the stock market and the deep-rooted uncertainties tied to economic factors and political decisions. With the Federal Reserve's cautious approach to adjusting interest rates amid inflation troubles and Trump's insistence on protective tariffs, the market faces tough realities as investors remain on high alert for any signs of recovery.

The tech sector, which had been viewed as the lifeline for investors fewer months back, now stands as the focal point of market anxieties. The upcoming weeks and months will be pivotal, as stakeholders assess how persistent inflation and political strategies affect economic recovery and stock performance, especially for industry titans like Tesla and Apple.