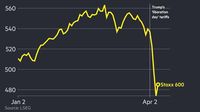

On April 8, 2025, the S&P 500 made a notable leap of 3.3% at the market open, signaling a resurgence in global markets as investors reacted positively to potential tariff negotiations amid ongoing tensions between the U.S. and China. This rebound was mirrored by the Dow Jones Industrial Average, which soared as much as 1,391 points during the trading session, reflecting a broader recovery across major stock indexes.

The surge in stock prices came as Treasury Secretary Scott Bessent indicated that the Trump administration was open to discussing lower tariffs with key trading partners, including Japan and Israel. Bessent's remarks provided a glimmer of hope to investors who had been rattled by the volatility of the previous trading day. "We could end up with some good deals," Bessent stated, hinting at the administration's willingness to negotiate in the face of escalating trade tensions.

Investors were encouraged by the prospect of a resolution to the tariff disputes, particularly after President Trump threatened to impose an additional 50% tariff on Chinese goods if Beijing did not retract its plans to retaliate against newly announced U.S. levies. The Chinese government responded firmly, with its Commerce Ministry declaring, "If the U.S. insists on its own way, China will fight to the end." This back-and-forth has raised concerns about a potential all-out trade war between the two largest economies in the world.

Despite this backdrop of uncertainty, the markets reacted favorably to the news of possible negotiations. The S&P 500, Nasdaq Composite, and Dow all gained over 3% on April 8, 2025, showcasing a significant recovery after a tumultuous previous day when markets gyrated wildly before settling largely unchanged.

The rally was driven by strong performances from major companies, particularly in the technology sector. Apple (AAPL), Nvidia (NVDA), and Tesla (TSLA) emerged as big winners, contributing to the overall positive sentiment on Wall Street. With these stocks leading the charge, investors are now keenly watching how the ongoing trade negotiations will impact corporate earnings in the coming quarters.

In addition to the U.S. markets, international stocks also experienced a boost. Japan's Nikkei 225 index surged by 6%, recovering from a previous sell-off. This rise was attributed in part to Bessent's comments, which signaled that Japan would be prioritized in upcoming trade discussions. Meanwhile, other Asian markets and European stocks also saw gains, particularly in the defense sector.

On the other hand, Indonesia's stock market faced challenges, tumbling upon reopening after a holiday that began before last week's "Liberation Day." The Southeast Asian country has been one of several targeted by Trump's hefty levies, which have raised concerns about economic stability in the region.

The bond market also reacted to the day's developments, with Treasury yields rising above 4.2% on April 8. The yield on ten-year Treasury notes settled at 4.164% after experiencing its sharpest one-day rise in a year, reflecting heightened investor activity and changing expectations regarding future monetary policy.

As the day progressed, the optimism surrounding tariff negotiations continued to fuel market momentum. The administration's willingness to engage in talks with various countries has led to a cautious optimism among investors, who are hoping for a resolution that could stabilize the markets and foster economic growth.

However, the specter of a prolonged trade conflict remains a concern. President Trump’s administration has positioned itself firmly against perceived unfair trade practices, and the ongoing exchanges with China suggest that tensions are likely to persist. The possibility of further tariffs could dampen the positive outlook if negotiations do not yield expected results.

As Wall Street navigates this complex landscape, analysts are urging investors to remain vigilant. The potential for sudden market shifts based on news from the White House or Beijing is high, and many are recommending that investors have strategies in place to manage risk. "What’s an investor to do? Start here," read a headline from a recent analysis, emphasizing the need for a disciplined approach to stock investing during these uncertain times.

In summary, the financial markets on April 8, 2025, demonstrated resilience in the face of adversity, with the S&P 500 and Dow Jones Industrial Average experiencing significant gains. The potential for tariff negotiations has sparked renewed investor interest and optimism, although the risks associated with ongoing trade tensions remain. As developments unfold, the focus will remain on how these negotiations will shape the economic landscape in the months to come.