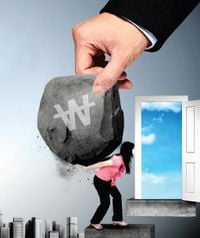

On June 19, 2025, the South Korean government unveiled an ambitious 1.4 trillion won supplementary budget aimed at revitalizing the nation's small business sector burdened by long-term debt. This sweeping financial relief package targets approximately 1.13 million small business owners saddled with a staggering 16 trillion won in overdue loans, many of which have lingered unpaid for over seven years.

At the heart of this initiative lies a three-pronged approach designed to alleviate the crushing debt load and foster economic recovery among vulnerable entrepreneurs. The government plans to implement a "Long-Term Delinquent Debt Adjustment Program," which involves the establishment of a specialized debt management entity, often referred to as a "Bad Bank," under the Korea Asset Management Corporation (KAMCO). This institution will purchase and subsequently forgive debts that are 50 million won or less and have been delinquent for more than seven years.

Specifically, the Bad Bank will acquire these long-overdue debts from financial institutions at a steep discount—approximately 5% of the original principal—reflecting the near impossibility of recovering these funds. For instance, if a small business owner borrowed 50 million won a decade ago and still owes 40 million won, the Bad Bank would buy this debt for around 2 million won and erase it entirely. This mechanism effectively wipes out the debt, offering a fresh start to those trapped in financial hardship.

The government estimates that about 16 trillion won worth of such debts exist, and it aims to purchase and forgive all of them by investing roughly 800 billion won—half of which will come from government funds, with the remaining half contributed by the financial sector. Financial Services Commission official Kwon Dae-young explained, "For those who have been burdened by debt collection pressures for around seven years and have lost their ability to repay, we will fundamentally eliminate their debts and help them return to economic activity." He emphasized that this program targets a small fraction—about 1 to 2 percent—of society's most financially distressed individuals, offering them a one-time, decisive debt relief to restore normalcy in their lives.

Importantly, this debt forgiveness program applies only to debts delinquent for seven years or more, excluding those incurred during or after the COVID-19 pandemic period. To address pandemic-related debts, the government is expanding the "New Start Fund" (새출발기금) program. Previously limited to vulnerable groups, the fund now extends eligibility to low-income individuals earning 60% or less of the median income. Eligible debtors with debts up to 100 million won can receive a 90% principal reduction, with repayment periods extended from 10 to 20 years. The application window, initially set from April 2020 to November 2024, has been extended through June 2025.

Alongside debt forgiveness, the government is also rolling out a "Diligent Recovery Program" to reward small business owners who have consistently repaid their debts despite hardships. Those verified to have maintained steady payments will benefit from extended repayment terms—up to seven years for businesses in distress and up to 15 years for those that have closed—with government support covering a 1 percentage point interest rate reduction. Closed business owners will also receive preferential interest rates as low as 2.7%. Additionally, the "Hope Return Package," which assists with store removal and restoration costs, will receive an extra 17.1 billion won, raising the maximum support limit to 6 million won until the end of 2025.

The Ministry of SMEs and Startups (MSS) is concurrently deploying this supplementary budget to bolster three critical areas: small business recovery and normalization, SME growth and regional economic revitalization, and the expansion of technology innovation. The MSS has allocated 312.5 billion won for small business owner recovery, 266 billion won for SME and regional economic revitalization, and 462 billion won to promote the supply and utilization of cutting-edge technologies.

Within these allocations, the MSS is extending long-term installment repayment periods from five to seven years and reducing interest rates by 1 percentage point for struggling small business owners. Regional credit guarantee foundations will convert debts of COVID-19-affected enterprises into long-term, low-interest special guarantees, with repayment periods for closed businesses extended up to 15 years. The smart store supply initiative is also expanding to meet on-site demand, reflecting a growing push towards digital transformation among small retailers.

For SME and regional economic growth, the government is channeling additional funds into startup packages, particularly to nurture promising deep tech startups specializing in artificial intelligence (AI), biotechnology, and other advanced sectors. An extra 42 billion won has been earmarked for these startup packages, while 200 billion won is designated for innovation commercialization funds. The ICT convergence smart factory program, designed to modernize manufacturing SMEs with AI and automation, has also received a 24 billion won boost, including a new AI-focused track.

Technology innovation receives significant attention, with 462 billion won allocated to support AI-driven regional transformation projects led by local governments. These projects encompass AI solution development, talent cultivation, and infrastructure building to foster vibrant local innovation ecosystems. Moreover, the "Mother Fund"—a key government-backed venture capital fund supporting deep tech startups aiming for unicorn status—has been supplemented with 400 billion won. The "Pre-Unicorn Startup 1000+ Project," aimed at nurturing high-potential startups, also gained an additional 12 billion won.

Despite the positive outlook, concerns about potential moral hazard and fairness linger. Critics warn that such widespread debt forgiveness might encourage some to deliberately avoid repayment, while those who have diligently repaid may feel unfairly treated. The government acknowledges these concerns but stresses that the program strictly targets individuals who have lost repayment ability akin to bankruptcy, minimizing risks of abuse. Financial authorities emphasize that the policy aims to provide a lifeline to the most vulnerable and to promote social integration through economic reintegration.

In parallel with financial relief, the government is investing 1.6 trillion won in employment safety nets. This includes increasing the number of recipients for job-seeking allowances by nearly 187,000 to 1.8 million people and expanding the National Employment Support System. Construction sector workers, for example, will see their training allowances rise by 200,000 won to 484,000 won per month. Housing stability initiatives are also enhanced, increasing the number of jeonse (lump-sum deposit) housing units for homeless youth and newlyweds by 3,000 to 48,000, and expanding monthly rent support for low-income youth by 27,000 to 157,000 recipients.

South Korea's small business landscape has been severely strained by the combined effects of the COVID-19 pandemic, prolonged economic stagnation, and rising interest rates. According to a survey by the Korea Economic Research Institute, many self-employed individuals reported significant declines in sales and profits last year. Empty storefronts and industrial vacancies in the Seoul metropolitan area paint a stark picture of the ongoing challenges.

By adopting this comprehensive debt relief and economic support package, the government aims to alleviate financial distress, facilitate business recovery, and stimulate broader economic revitalization. As Yoo Byung-seo, head of the Ministry of Strategy and Finance's Budget Office, summarized, "The total number of beneficiaries is 1.13 million, with approximately 400 billion won invested from government funds and an additional 400 billion won jointly borne by the financial sector." He added that the program represents a shared commitment to support small business owners and promote economic resilience.

While the road ahead may still be challenging, these targeted measures offer a beacon of hope for many struggling entrepreneurs seeking a fresh start in South Korea's evolving economic landscape.