On March 20, 2025, the stock market witnessed a significant downturn in the shares of leading wire and cable manufacturers due to rising competition in the sector. Polycab India, KEI Industries, and Havells India are among the companies affected, with their stock prices plunging sharply, creating ripples in the financial market.

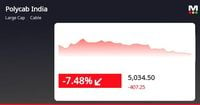

Polycab’s shares, which were priced at Rs 5,441.75 the previous day, dropped to an intraday low of 8.92%, settling at approximately Rs 4,982.65, marking an 8.44% decline by 10:16 AM. The company's stock has faced a staggering depreciation of 32% year-to-date and a 24% decline over the last six months.

KEI Industries observed an even steeper decline, plunging 14.3% to Rs 2,809.85, and fell victim to the impact on its market capitalization, dropping below Rs 28,000 crore. This stock has now lowered its valuation more profoundly in response to emerging threats.

Havells India Limited also suffered, experiencing a fall greater than 5%, with shares trading at Rs 1,473.65, bringing its market capitalization to less than Rs 95,000 crore. A brief rally of 3% over the preceding week could not sustain the optimism as competitive pressures mounted.

The catalyst for this sell-off is rooted in the announcement made by Adani Enterprises, which revealed its entry into the wires and cables market through a joint venture with Praneetha Ventures. This venture, Praneetha Ecocables Ltd., will manufacture, market, distribute, and sell metal products and cables. Such aggressive expansion tactics from Adani, particularly through its subsidiary Kutch Copper Ltd., are raising alarm bells among established players.

Adani’s investment in a copper smelter located in Mundra, Gujarat, expected to produce 0.5 million tonnes annually, further amplifies concerns surrounding competitive pressure. UBS noted that competition in the cable market continues to intensify, especially with this “second large serious player” entering the fray. This imminent competition is underscored by the significant losses faced by players like Polycab and KEI.

In a troubling trend, the industry has suffered substantial market cap losses recently; it was reported last month that a capital commitment by UltraTech Ltd. for Rs 1,800 crore to encroach upon the sector led to a startling decline of about Rs 30,000 crore in cable stocks' value. This highlights a growing unease among investors regarding the long-term sustainability of existing market titans.

The figures paint a stark picture of the competitive landscape: Polycab stocks have plummeted by more than 32% in the past year alone, reflecting investors’ wariness towards the company’s ability to maintain its market position amidst the intensifying pressure. Havells too demonstrated a troubled past, with a 10% drop over six months now cementing doubts regarding its future trajectory.

Furthermore, other smaller competitors, such as Finolex Cables, also descended, with share prices falling over 4.75% to Rs 827, exemplifying the widespread sell-off that the cables market has experienced. Companies like Dynamic Cables and Plaza Wires similarly felt the heat, detailing price reductions in their stocks as well.

This turbulence in the wires and cables industry highlights the fragility of companies reliant on a stable competitive environment. Industry analysts suggest that existing companies must adapt to fend off the new entrants aggressively if they aim to preserve their market shares and continue to attract investor confidence.

As companies navigate this fresh wave of competition, they might need to boost their strategic initiatives and innovations. Many experts in the financial sector believe that while established firms have historically held strong market positions, Adani's disruptive entry could spur significant changes in pricing strategies and competitive dynamics.

The implications of these shifts could resonate across the market, potentially leading to unstable conditions for industry players in the short term. For now, investors are advised to keep a keen eye on developments as Adani's expansion unfolds and to gauge how incumbent firms reposition themselves to endure these competitive pressures.

In conclusion, March 20, 2025, stands as a major marker for the wires and cables sector, as new competition from heavyweights like Adani Enterprises reshapes the landscape. Stakeholders are reminded that the path ahead will likely involve complex strategies and adjustments on behalf of the established firms to mitigate the adverse effects brought on by enhanced competition.