Shares of Palantir Technologies Inc. took a significant hit in after-hours trading on May 5, 2025, falling more than 8% despite the big data analytics company reporting a strong first quarter that matched or exceeded expectations. The decline in stock price came as investors appeared to have anticipated even stronger results given the company’s recent performance.

For the fiscal 2025 first quarter, which ended on March 31, Palantir reported adjusted earnings per share of 13 cents, a notable increase from 8 cents per share during the same quarter in 2024. The company’s revenue for the quarter reached $883.9 million, reflecting a 39% year-over-year rise and surpassing the analyst consensus of $862.2 million, according to FactSet.

Palantir's U.S. revenue surged by 55% year-over-year, totaling $828 million. This growth was bolstered by a remarkable 71% increase in U.S. commercial revenue, which reached $255 million, alongside a 45% rise in U.S. government revenue, amounting to $373 million. The quarter also marked a record for U.S. commercial contract value, which soared to $810 million—up nearly threefold from the previous year.

Moreover, the company’s total U.S. commercial remaining deal value climbed 127% to $2.32 billion as of the end of March 2025. Palantir closed 139 deals of at least $1 million in the quarter, including 51 deals worth at least $5 million and 31 deals exceeding $10 million. This robust performance was attributed to new deals and an increase in customer count, which rose by 39% year-over-year.

CEO Alex Karp emphasized the company’s commitment to execution during the post-earnings conference call, stating, "We're going to just focus, and focus, and focus and focus on execution. And that is basically our plan for the rest of the year." He added that Palantir is in the midst of a significant shift in software adoption, particularly in the U.S., where revenue growth has been substantial.

In addition to its financial results, Palantir has been making strides in technological advancements. The company integrated xAI Corp.’s Grok-2 and Grok-2 Vision models into its Artificial Intelligence Platform, enhancing capabilities across various tools. Furthermore, Palantir introduced a new Model Experiments application programming interface (API), allowing developers to optimize machine learning models more effectively within existing workflows.

Palantir also announced a strategic partnership with Databricks Inc., aimed at combining its AI operating system with Databricks’ data engineering and analytics platform. This collaboration seeks to deliver a more unified AI and data solution for both enterprise and government customers.

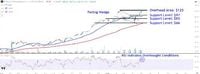

Despite the positive developments, the stock saw a sharp decline after the earnings report. The shares, which had previously rallied to their highest level since mid-February, faced significant selling pressure around this peak, leading to a drop of over 9% to $112.32 in after-hours trading.

Investors had high expectations heading into the earnings report, as Palantir shares had increased by 64% since the beginning of the year and had more than quintupled over the past 12 months. This surge was largely driven by optimism surrounding the company’s potential to benefit from the growing demand for enterprise AI solutions and federal initiatives aimed at improving government efficiency.

Palantir’s outlook for the fiscal second quarter is promising, with expected revenue between $934 million and $938 million and adjusted income from operations projected at $401 million to $405 million. This forecast is notably above the $899.4 million expected by analysts. For the full fiscal year, the company raised its revenue guidance to between $3.89 billion and $3.902 billion, an increase from the previous estimate of $3.74 billion to $3.75 billion.

However, the market’s reaction indicates that investors are closely monitoring the stock’s performance. Analysts are suggesting that investors should keep an eye on key support levels around $97, $83, and $66, while also watching for resistance near $125. The technical analysis suggests that the stock may be forming a double top pattern, which could indicate further volatility in the near future.

As Palantir continues to navigate the complexities of the tech market, its focus on execution and strategic partnerships may prove crucial for its future growth. The company’s ability to sustain momentum in its revenue growth amidst rising investor expectations will be a pivotal factor in its stock performance in the coming months.