Nvidia is set to release its eagerly awaited fourth-quarter earnings report on February 26, 2025, with Wall Street holding its breath as expectations soar amid the accelerating AI revolution.

Analysts predict the semiconductor giant will report record revenue of approximately $38.32 billion, reflecting a staggering 73% year-over-year increase. This news, expected to come after the market closes on Wednesday, has analysts on high alert, with some expressing anxiety over the sustainability of Nvidia's meteoric rise.

The stock has surged dramatically, buoyed by insatiable demand for AI chips. "Nvidia has a strong track record, having beaten Wall Street estimates in 16 of the last 18 quarters – but with expectations already sky-high, even a solid beat may not be enough to keep the stock moving higher," noted John J. Hardy, Global Head of Macro Strategy.

Recent forecasts from analysts at Wedbush and Oppenheimer suggest Nvidia shares could see up to 30% upside from their February 2025 closing price. This bullish sentiment follows comments from UBS analysts emphasizing potential supply chain improvements attributed to the highly anticipated launch of Nvidia's Blackwell chips.

But the question haunting many investors remains: is this phenomenal growth sustainable, or are we teetering on the edge of another market bubble reminiscent of the dot-com crash?

The AI sector has turned Nvidia's GPUs—the mainstay of computing power for AI model training—into highly sought-after commodities. Still, skepticism abounds, with some market observers warning of overly optimistic valuations. "The options market is pricing in a 7-8% move post-earnings, indicating a wide range of possible outcomes," reported Investing.com.

The rush among companies to secure Nvidia's chips has raised eyebrows. Yet, as competition intensifies—evidenced by recent market jitters following the emergence of Chinese AI firm DeepSeek, which claims to train models with significantly fewer GPUs—investors are watching closely. Nvidia's stock dropped 4.1% recent, marking significant concern about market conditions.

Another angle investors are zooming in on is Nvidia's gross margins. Although the company historically reports healthy margins—75% this past quarter—industry trends suggest rising production costs, which could squeeze profitability. Investors expect guidance to hover around the 73% gross margin mark for the upcoming quarters.

Despite these challenges, Nvidia remains positioned as the backbone of AI technology, with corporate giants like Microsoft, Google, and OpenAI vying for its GPUs. Strategic AI investments from regions like Europe, where nations like France aim to build substantial AI infrastructures, aim to establish independence from companies like Nvidia.

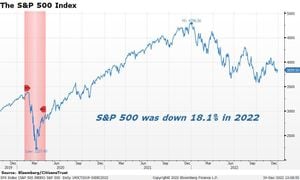

Looking at stock trends, Nvidia shares have fluctuated significantly this year. The firm has faced considerable selling pressure, trailing several key technical levels. Analysts have pointed out major support levels at $130, $113, and $102, with key resistance levels at about $153 and $174.

The current sentiment is divided; many bullish analysts foresee great outcomes should Nvidia exceed earnings expectations. Conversely, if Nvidia falls short of projections, even slightly, it could trigger widespread panic, affecting not just Nvidia but also the broader technology sector, especially AI-related stocks.

“We’re entering earnings season fraught with mixed sentiment—optimism clashes with caution—leading to potential volatility,” highlighted market analysts. Should Nvidia post strong numbers and guidance, this may fuel prolonged interest and investment across AI markets. But should there be signs of weakness or hesitation from management, it would likely lead to significant declines.

Overall, Nvidia's earnings report will serve as much more than just another quarterly update; it will act as a referendum on the AI boom itself. Investors ought to brace themselves for potential wild market reactions, regardless of the results. Whatever happens, the stakes couldn't be higher for everyone involved.