The Tokyo stock market saw a positive turn on March 25, 2025, with the Nikkei average rebounding for the first time in four days. The index closed at 37,780.54 yen, gaining 172.05 yen, or 0.46%, from the previous day. Throughout the morning session, the rise briefly exceeded 500 yen due to favorable conditions influenced by substantial gains in U.S. stocks.

Investor sentiment was buoyed by reports that concerns over the U.S. government's tariff policies were easing. The Nikkei average, which opened at 37,953.15 yen, climbed to a high of 38,115.65 yen at 09:32 but later faced resistance around the 38,000 yen mark. Analysts noted that although the gains were substantial, the market had matured into a phase of profit taking after the initial spike.

According to CNBC, U.S. President Donald Trump, in remarks on March 24, had hinted at the possibility of granting tariff reductions to a broad range of countries and specifically stated that certain tariffs on pharmaceuticals and semiconductors might be announced soon. These statements alleviated some fears and contributed to the positive market atmosphere in Japan.

On the Tokyo market, stock trading was lively, with a total volume of around 1.644 billion shares traded, and a trading value approximating 3.934 trillion yen. The improvement in sentiment resulted in over 1,000 stocks rising on the Prime market, accounting for more than 60% of the total, although the trading value remained below the crucial 4 trillion yen threshold for two consecutive days.

Key stocks benefiting from this rally included Fujikura, which managed to lead in trading volume. Other notable performers were Disco, Toyota Motor, and Fast Retailing, boosting the Nikkei average significantly. Despite the gainers, there were also notable losers today, including Mitsubishi Heavy Industries and Advantest, the latter falling sharply after an earlier surge. This was a direct correlation to market trends as institutional investors shifted their capital from value stocks like banks to industries with more growth potential, notably semiconductors.

In examining the sector performance, rising industries included precision instruments and real estate, along with notable gains in fiber products and service sectors. Contrastingly, the banking and electric utility sectors witnessed declines, indicating a clear market rotation as investors strategized their asset allocations based on current economic conditions.

Speculation also arose around whether investors were making moves to buy back oversold growth stocks, as fears regarding U.S. tariffs appeared to diminish. The trading today also suggested that these trends reflect a broader adjustment by institutional investors looking to enhance their portfolios ahead of the upcoming financial reporting season.

In terms of overall contribution to the Nikkei index, key players included Fast Retailing, Terumo, and TDK, which collectively pushed the index up by approximately 80 yen, while negative contributions came mainly from Advantest, Seven & i Holdings, and M3, which dropped the index by about 81 yen.

Even though the market showed signs of recovery, analysts continued to caution about volatility. A number of stocks were under pressure from profit-taking and inconsistencies within economic signals. A chief strategist at T&D Asset Management remarked, "There may be movements to readjust portfolios that have been previously sold off in semiconductor-related sectors, which could be a positive signal for the market’s stability moving forward."24

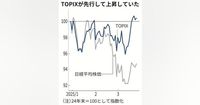

The day's trading closed with the Nikkei at a better position than earlier in the week, showing resilience with a closing value at 37,780.54, up from 37,608 yen from the previous day. However, continued vigilance among investors is advised as the market navigates periods of heightened uncertainty, particularly with external influences from the U.S. economy. The Tokyo Stock Price Index (TOPIX) also reported a gain of 6.64 points, closing at 2,797.52.